GBP / USD

The British pound yesterday surprised the market by an increase of 140 points at the moment. The reason for this was the information that Germany is ready to make some concessions to the UK in terms of trade agreement. But a little later, the news agencies surprised the second time, it turns out, Germany did not put forward any initiatives on this issue. On such a joke, the price closed the gap. The index of business activity in the service sector in the UK increased to 54.3 from 53.5 in August. This helped the pound not fall very much back. As a result, the growth was 51 points.

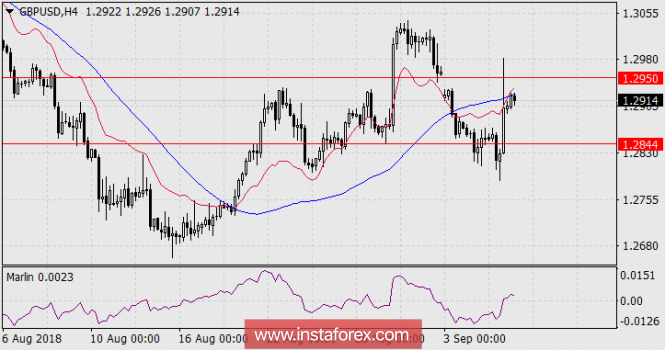

At the moment, the price is under the descending line of the price channel and under the balance line on the daily chart. The price outflow over these resistance is quite probable, since the signal line of the Marlin oscillator grows after a turn from the border with the zone of negative numbers. After fixing the price above 1.2950, it is possible to consider target 1.3102 - the maximum of July 13 and June 21.

But even with the formation of initial conditions for growth on a daily scale, this growth may have difficulties. On the four-hour chart, the price is below the red balance line. This means that growth will occur on the concessions of the "bears", which can then go on the offensive. Also on the daily chart, the price, having passed the level of 1.2950, may still remain under the balance line. To change the price, it is necessary to break up sharply, but this potential was already used yesterday.

The situation on the next day is uncertain. Turning prices down from the indicator lines on both timeframes can also be. Before the US data on employment there was one day, investors can wait. We expect to trade in the range of 1.2844-1.2950.

The material has been provided by InstaForex Company - www.instaforex.com