The fundamental analysis is not static. The most serious divergence in the economic growth of the US and the eurozone from 2014, the rate increase at 3-4 Fed meetings in 2018 and the ECB retention expected on September 2019, does not mean that the EUR/USD pair is necessarily to move down. These "bearish" drivers are mostly played already. The question is whether the US GDP will continue in the same spirit as it did in the second half of this year, and whether the euro-zone economy will continue to slow down? If not, the euro will start licking wounds.

Assessing the minutes of the last meeting of the FOMC, the Federal Reserve representatives are beginning to express concerns about the negative impact of trade wars, aggressive monetary policy and the gradual reduction of the effect of tax reform towards the US economy. At the same time, the revaluation of the dollar is capable of slowing down inflation. As a result, the reasons for raising the federal funds rate will be significantly less than now. The slowdown in the normalization process will be an important factor in the growth of EUR/USD.

The main reasons for the weak start of the eurozone in 2018 involves the strengthening of the euro in 2017, trade wars, bad weather, strikes by German workers and the flu epidemic. The last three are temporary, the truce between the EU and the US reduces geopolitical risks, and the fall of the main currency pair by almost 8% of the February high levels that provides an excellent opportunity for the European exporters to prove himself.

The policy deserves special attention. The risks of the withdrawal of the eurosceptic government in Italy from the EU requirements of a 3% budget deficit led to sales of local bonds. Non-residents withdrew from the debt market of the republic worth € 34 billion and € 38 billion on a net basis in June-July. However, is there any guarantee that the outflow will continue? If Rome takes an adequate budget, reducing political risks will open the way for the EUR/USD to move to the north. On the contrary, the United States may begin to experience problems as the November elections to Congress approach.

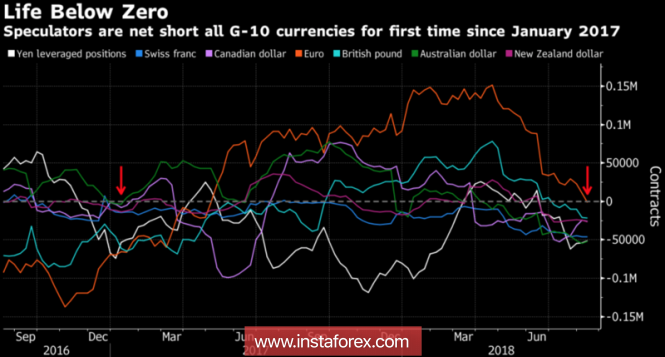

Divergence in economic growth and in monetary policy led to the fact that for the first time, since early 2017 speculative positions on all G10 currencies against the US dollar reached the red zone. At the same time, the recent Reuters' poll of experts indicate that the "American" rally is unlikely to extend. Closing long positions on the USD index will help reverse the downtrend in the EUR/USD.

Dynamics of speculative positions by G10 currencies

Thus, the strong positions of the US dollar resemble a mirage in the desert, but personally I do not have a crystal ball to predict the future. The scenario described above looks quite realistic, but there is a truce between the EU and the States to end, and political risks in Italy will increase, as it need to make adjustments.

Technically, the "bulls" for EUR/USD are set to activate and implement the pattern of "Cheating-ejection". To do this, they need to return the quotes of the pair to the middle of the trading range 1.15-1.18, and then take the resistance by 1.17-1.1705 by storm.

EUR / USD daily chart

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com