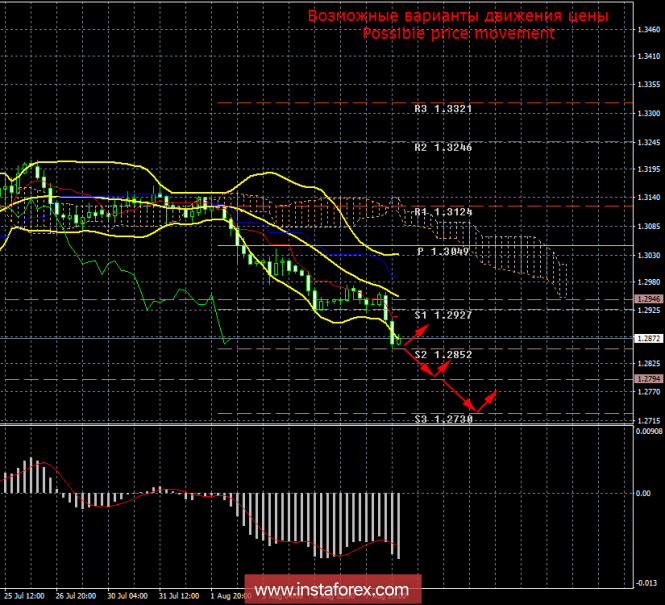

4-hour timeframe

Amplitude of the last 5 days (high-low): 49p - 115p - 68p - 93p - 50p.

The average amplitude for the last 5 days: 75p (82p).

The currency pair GBP / USD on Wednesday, August 8, after a two-day marking in one place, resumed the fall, breaking the first support level of 1.2927. At the American trading session, the price worked out the second support level of 1.2852 and rebounded from it. Thus, in the next few hours, the pair still has a chance to start a correction. The reasons for the resumption of the downward movement in the pair lie in the introduction of new trade restrictions for China by the States. In addition, the US leader Donald Trump once again threatened the PRC to impose duties on all exports from this country. In dollar terms, this amount is $ 500 billion. It was on these news that the US dollar began to appreciate again, as market participants continue to regard any new sanctions imposed by the US as a sign of their leader's strength and expect positive effects for the country's economy. We still believe that even though the US dollar, in any case, looks now much stronger than the pound, as in Great Britain there remains a huge number of unresolved problems, the positive effect of the trade war for the national currency is a temporary phenomenon. Sooner or later, there will be negative consequences from trade restrictions and the US economy. From Great Britain, new interesting information on Brexit also arrived. If earlier, Theresa May accused the EU of dragging out negotiations on Brexit, but now she was convicted of wanting to postpone the negotiations until November. Theresa May expects Trump will continue to try to frustrate the G-20 summit, and this will be of great concern to the EU. So much to worry that they will want to close all questions as soon as possible on the exit of Britain from their composition. Thus, May's subtle calculation partly recognizes her inability to settle all Brexit questions honestly. On the other hand, the British prime minister is clearly heading towards his goal and is trying to keep falling popularity ratings.

Trading recommendations:

The GBP / USD currency pair worked at 1.2852. Thus, an upward correction is now possible, which can be traded in small lots with the target of 1.2946, which is derived from the average volatility of the instrument in recent days.

Orders for sale can be opened after receiving a signal about the completion of the correction or in case of overcoming the level of 1.2852. In this case, the bears will again begin to attack the positions of the British pound with the targets of 1.2794 and 1.2730.

In addition to the technical picture, one should also take into account the fundamental data and the time of their release.

Explanations to the illustration:

Ichimoku Indicator:

Tenkan-sen is a red line.

Kijun-sen is a blue line.

Senkou Span A is a light brown dotted line.

Senkou Span B - a light purple dotted line.

Chinkou Span is a green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and histogram with white bars in the indicator window.

The material has been provided by InstaForex Company - www.instaforex.com