EUR/AUD has been volatile and corrective recently after an impulsive bullish counter-trend momentum which is expected to push lower in the coming days. EUR has been struggling to maintain momentum in the market as of the weak fundamentals and Trade War tensions which lead the market sentiment to shift away from EUR to AUD.

Today EURO Final Services PMI report was published with a slight decrease to 54.2 which was expected to be unchanged at 54.4 and Retail Sales report is yet to be published which is expected to increase to 0.4% from the previous value of 0.0%. Moreover, Italian, French, German and Spanish PMI report was quite mixed showing no definite indication for further momentum in the coming days.

On the AUD side, Today AUD Retail Sales report was published unchanged at 0.4% which was expected to decrease to 0.3% and AIG Service Index report was published with a decrease to 53.6 from the previous figure of 63.0.

As of the current scenario, despite the mixed economic reports on the AUD side today, it gained impulsive momentum over EURO in the process which does indicate the weakness of the EURO in comparison to AUD. As AUD maintains the optimistic approach further, more downward momentum in the pair is expected.

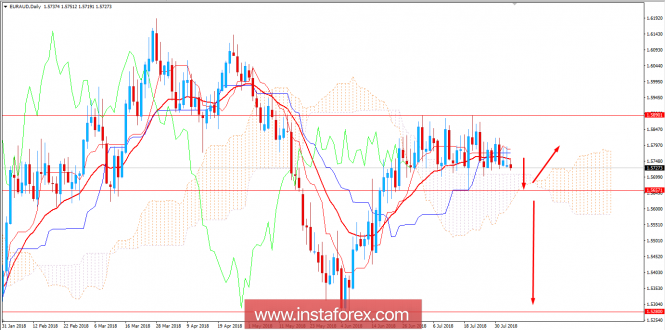

Now let us look at the technical view. The price is currently rejecting off the dynamic levels of 20 EMA, Tenkan and Kijun line from where it is expected to push lower towards 1.5650 area. If the price manages to break below 1.5650 with a daily close in the coming days then further bearish momentum with a target towards 1.53 area is expected. On the other hand, if the price rejects the bears off the 1.5650 area and manages to push higher it is expected to proceed higher with a target towards 1.59 area. As the price remains below 1.59 area, the bearish bias is expected to continue further.

SUPPORT: 1.5650, 1.5300

RESISTANCE: 1.5900, 1.6000

BIAS: BEARISH

MOMENTUM: VOLATILE AND CORRECTIVE