If in the first half of the day, the euro tried to hold positions in tandem with the US dollar in the 1.1710 area, the weak data on sentiment in the eurozone economy and a good report on spending by the Americans resumed a downward correction in risky assets.

According to the report of the Federal Employment Bureau of Germany, the number of applications for unemployment benefits in August this year decreased by 8,000 compared with July. The data fully coincided with the forecast of economists. The unemployment rate in Germany was 5.2%, as in July. The Bureau noted that the situation in the labor market continues to develop in a positive direction.

The index of consumer confidence in the euro area in August this year dropped to -1.9 points against -0.5 points in July. The main pressure was created by trade wars waged by the United States, and also because of the uncertainty associated with Brexit and the political situation in Italy.

The index of sentiment in the eurozone economy in August dropped to 111.6 points against 112.1 points in July, while it was forecasted that the index will be at 112 points.

The decline in confidence was noted both in the service sector, where the index fell to 14.7 points against 15.3 points in July, and in the eurozone industry, where the index was 5.5 points against 5.8 points in July.

Data on the US labor market were ignored by the market. Despite the fact that the number of Americans who applied for benefits for the first time last week increased slightly, the US dollar continued to gradually strengthen against risky assets.

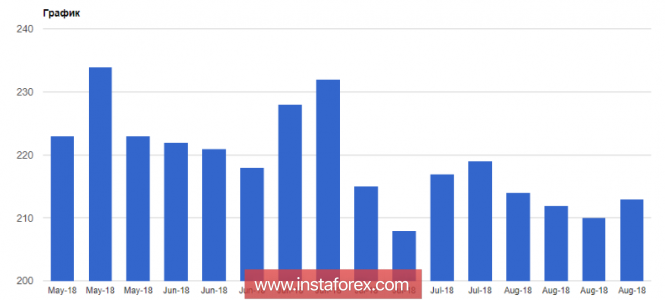

According to the report of the US Department of Labor, the number of initial applications for unemployment benefits for the week from August 19 to 25 increased by 3000 and amounted to 213,000. Economists had expected the number of applications to be 215,000.

Good support for the American currency was provided by a report in which it was reported that the growth of spending by Americans in the past month outpaced the growth of their incomes. This suggests that households believe in the strength of the economy and are optimistic about the future without fear of falling income levels.

So, personal spending in the US in July rose by 0.4%, which fully coincided with the forecasts of economists. Personal incomes of Americans in July increased by 0.3% compared to the previous month, which also coincided with expectations.

As for the technical picture of the EUR / USD currency pair, it remained unchanged compared with the morning forecast. Buyers were unable to return to the resistance level 1.1710, and now the market is dominated by sellers who will try to poke the pair into the support area 1.1650 and 1.1600.

The material has been provided by InstaForex Company - www.instaforex.com