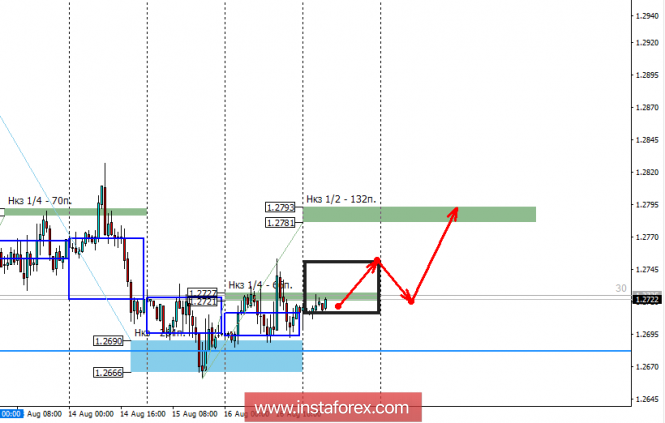

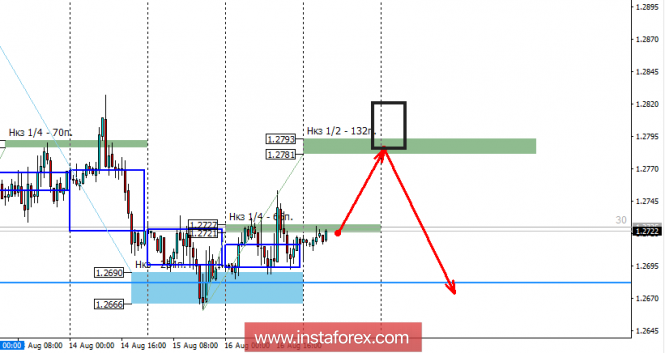

In the past Wednesday, the pair tested the monthly short-term fault of August and the weekly short-term fault of 1.2690-1.2666, which was the main target of the bearish momentum. The emergence of demand and holding prices above the monthly short-term is the basis for building a trading plan.

Yesterday, the formation of a local accumulation zone continued. Closure of the trades occurred below the NCP 1/4 1.2727-1.2721, which does not allow buying today, however, closing today's trading above this zone will allow us to look for favorable prices on the purchase already on Monday. The probability of growth increases due to the fact that the day before yesterday the pair tested a monthly short-term fault, which indicates the passage of the monthly average. Keeping the price higher than the monthly shortage before the end of the current month is the basis for finding favorable prices for buying corrective upward movement in the field.

Today's movement can continue the flock structure. To do this, it will be required to keep the price below the NCP 1/4 by the time of the close of trading. In this case, the retest of the monthly short-term fault and the update of the August low will be more likely next week.

To continue the downward movement, it is required that the pair trade below the NCP 1/2 1.2793-1.2781, and its test led to an increase in supply and absorption of the last growth. This will make it possible to search for sales, the purpose of which will be a return to the monthly short-term fault. The ratio of risk to the profit of a short position will be close to 1/3, which makes it possible to sell a limit order out of the zone. The stop must be at least 30 points.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com