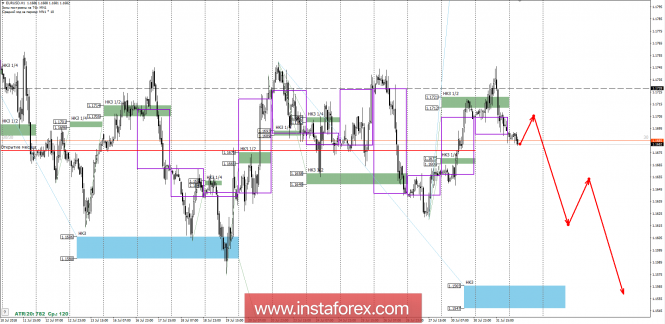

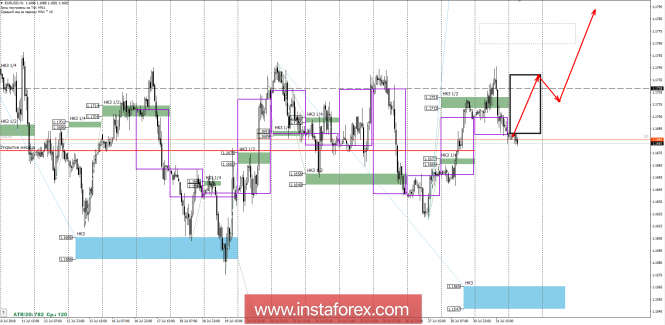

Yesterday, there was a test of NKZ 1/2 1.1721-1.1712 which acts as the determining resistance in the current flat phase of the market. The false breakdown of this zone indicates the continuation of work in the medium-term accumulation zone.

After the formation of the reversal downward model on July 26, the main resistance was the NKZ 1/2 1.1721-1.1712, the test of which occurred yesterday. Closure of the American session occurred below the zone which indicates a top-down priority. Since the last week's maximum was not updated, the target of the fall is the weekly KZ 1.1565-1.1547, where fixation of the short position will be required. It is important to note that above the 1.1728 level, there remains a zone of large limit orders. This suggests that large players are interested in keeping the euro below the specified mark.

The first point for possible fixations of sales is the minimum of last week, the test of which can lead to the emergence of demand and the corrective growth of the pair. This will give an opportunity to reopen sales at favorable prices.

To eliminate the downward impulse, the closing of today's US session should be above the NKZ 1/2 1.1721-1.1712. This will disrupt the current medium-term accumulation zone and allow us to consider growth in the long term. Purchases will come initially tomorrow, and the downward medium-term model does not work. The probability of implementing the upward model is 30%, which makes it a support and the main work should be conducted to the direction of weakening the euro.

Daytime CP is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

Weekly CP is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

Monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com