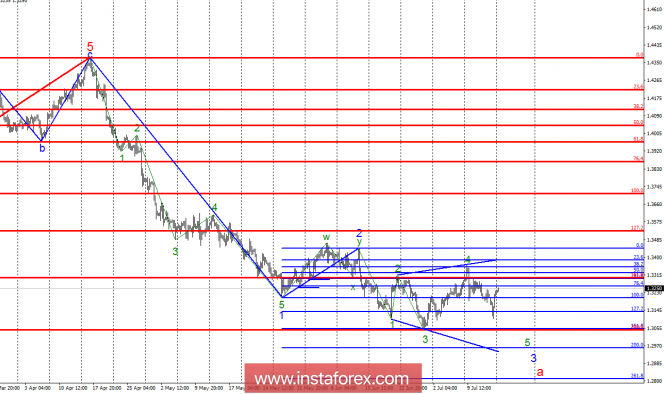

Analysis of wave counting:

On July 13, the GBP/USD pair gained about 30 bp, although during the day the amplitude of the instrument moves much higher. Despite the increase in quotes, the pair is expected to remain within the framework of the wave construction of 5, at 3, in a, with a target of about 200.0%. In this case, the pair will resume the decline from the current positions or slightly higher. Since the whole wave 3, in a takes the form of a diagonal triangle, its internal wave 5 can turn out to be the most extended. There are no basis for the assumption of breaking the execution of the working level alternative.

Goals for buying:

1.3445 - 0.0% Fibonacci (official target)

Goals for selling:

1.3054 - 161.8% by Fibonacci

1.2962 - 200.0% by Fibonacci

1.2809 - 261.8% Fibonacci retracement

General conclusions and trading recommendations:

The GBP/USD pair continues to build wave 5, at 3, in a. Thus, the decline in quotations may resume, and it is recommended to sell the pair with the targets near the marks of 1.3054 and 1.2962, which corresponds to the 161.8% and 200.0% of Fibonacci. Only the breakthrough of the maximum proposed wave 4 will indicate the willingness of the instrument to build an upward set of waves and will require updating corrections to the current wave figure.* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com