Eurozone

Today, the next ECB meeting on monetary policy will be held. Market participants do not expect any changes, the main intrigue will be the possible changes in the wording in the accompanying statement and commentary of Mario Draghi at the press conference because regarding the timing of the first rate hike the market is not completely clear.

The dynamics of European bonds is weak, the yield growth is minimal, which means the market's confidence in the absence of any significant changes. The curtailment of the asset repurchase program will go according to plan, any easing in this matter is likely, taking into account the negative yields of short euro-zone bonds.

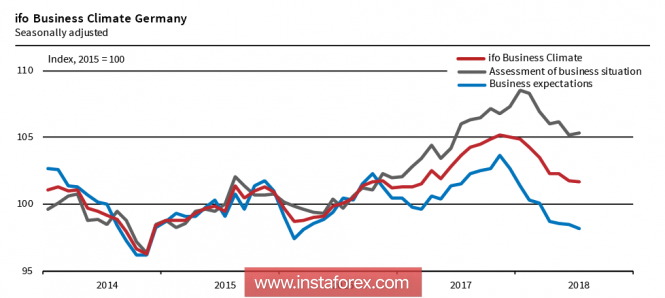

Macroeconomic statistics does not give any new benchmarks. Business activity in the euro area continues to slow, the indices of Ifo in Germany in July slightly decrease compared to June, a similar conclusion gives the consumer confidence index Gfk, which lost 1 point relative to 10.7p last month.

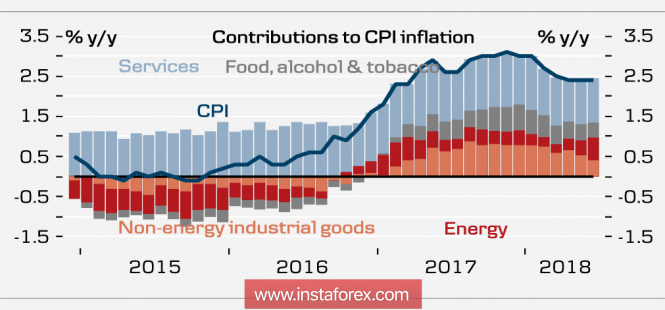

The growth of inflation is due to a significant increase in energy prices, so any hints at the acceleration of normalization may strike a blow to consumer confidence. At the same time, the spread of yields between 10-year German bonds and Treasuries has reached record levels, which pushes the ECB to greater decisiveness.

Negotiations between Trump and the head of the European Commission Juncker gave the result, which led to the growth of the euro, but the truce is temporary. The agreements do not cover the automotive sector, besides the EU will have to increase LNG from the US. Nevertheless, the players appreciated this move positively, and by the end of the day, if the ECB meeting is held in accordance with expectations, EUR / USD may rise above 1.1785 with a probable attempt to test for strength 1.1850.

The United Kingdom

Next week, the Bank of England will hold a meeting at which the rate is expected to be raised from 0.50% to 0.75%. This increase is expected for a long time, macroeconomic indicators are not hampered, as the unemployment rate is low, inflation is higher than the target, and business activity has recovered from the recent fall.

The Bank of England focuses its attention on the possible overheating of the economy, this issue worries much more than some slowdown in inflation. Like most world securities, BoE proceeds from the truth of the Phillips curve, according to which the tightening of the labor market automatically leads to an increase in inflationary pressures.

Unlike the Fed, BoE does not consider it necessary to reduce the number of redeemed bonds, since the rate is still low, at the previous extended meeting this issue was specially stipulated - no reduction until the rate reaches 1.5%. As the markets proceed from the average rate of growth rates at 0.25% per year, we can assume that this factor will be a long-term bearish factor for the pound.

The pound may try to resume growth in the coming days, but, most likely, any possible rally will be short-lived.

Oil and ruble

Quotes of oil remain stable near the reached annual maximums due to the absence of new factors that can change the fragile balance. The OPEC + countries are planning to increase production, negotiations on a new structure based on OPEC + are going well, and one can be sure that prices will remain under control.

Brent will continue to trade in the range, a slight preponderance of purchases is likely to reach 76.90.

The ruble will continue to weaken under the influence of a number of negative factors. Political pressure on Russia may increase, the probability of extending the sanctions regime to sovereign debt is growing. The meeting of the Bank of Russia today also will not be aggressive, according to the market, the issue of rate reduction will be postponed until at least 2019. Correction decrease RUB / USD to 62.83 short-term, more likely the resumption of growth with the target of 63.95.

The material has been provided by InstaForex Company - www.instaforex.com