It was the day of Independence in the US on Tuesday, which will lead to a noticeable decline in the number of market participants from America and will probably be the basis for a partial profit taking with a local weakening of the US dollar.

The dollar is moderately declining in the foreign exchange market, in our opinion, due to the profit-taking by investors against the background of the actually shortened global trading session from the weekend in the US. It is also pressured by a decrease in tension in the media regarding the situation around the trade wars. But, despite this dynamic, we are still considering a promising strengthening of the dollar, which is likely to occur smoothly, so we consider it interesting to buy the dollar in its drawdown.

Support for the exchange rate of the US currency is still a factor of trade wars, which forced market players to remember the very forgotten in the post-crisis time of its property safe-haven against the background of all kinds of crisis phenomena. In addition, we recall that it is supported by the decision of the Fed to move more actively in the process of raising interest rates.

On Tuesday, the RBA has decided to leave the main interest rate unchanged at 1.50%. Recall that it has not changed since the middle of 2016. At the same time, the regulator made it clear in its resolution that it will not change the monetary rate, despite the expectation of positive changes in the labor market and maintaining inflationary pressure near the 2.0% mark. At a press conference, the Governor of the Central Bank of Australia P. Lowe expressed the fear that the trade conflict between America and China could harm not only the countries with emerging economies. In general, the outcome of the meeting was neutral or slightly positive, which supported the Australian dollar, which turned up against the "greenback", buoyed by profit-taking on the US dollar.

Estimating the day's outlook for the currency market, we believe that activity towards the end of trading in Europe will fall to almost zero due to the absence of investors from the United States on the market.

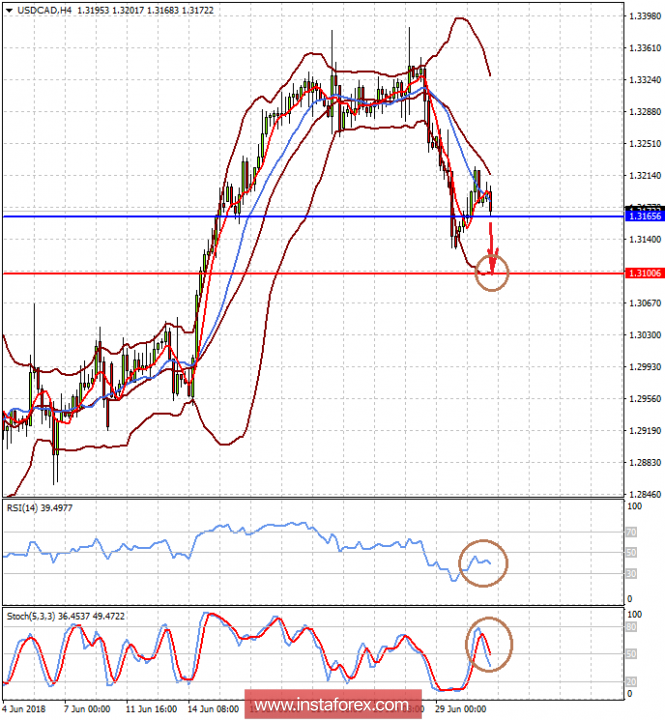

Forecast of the day:

The AUD/USD pair is recovering on the wave of the results of the RBA monetary policy meeting and profit taking on the US currency against the background of the weekend in the United States. The pair has a local growth potential to 0.7415 and then to 0.7445.

The USD/CAD pair is testing the 1.3165 mark on the wave of the strengthening of crude oil prices, as well as the reduction of a number of long positions on the US dollar. Against this background, the pair may fall to 1.3100.