Dear colleagues.

For the currency pair Euro / Dollar, the price forms the potential for the top of July 13, the dynamics increase can be expected after 15:00. For the Pound / Dollar currency pair, the price forms the potential for the top of July 13, the development of this structure can be expected at 10:00 - 12:00 and the breakdown at the level of 1.3248 is required. For the currency pair Dollar / Franc, the price is in correction from the upward trend. For the currency pair Dollar / Yen, the continuation of the development of the upward structure from July 9 is expected after the passage at the price of the noise range of 112.73 - 112.93. For the currency pair Euro / Yen, we follow the local upward structure of July 11 and the level of 130.85 is the key support. For the Pound / Yen currency pair, the development of the local upward structure is possible after the breakdown of 149.45.

The forecast for July 16:

Analytical review of currency pairs in the scale of H1:

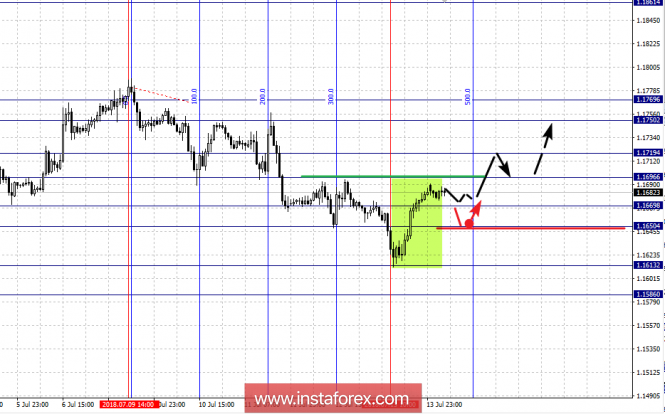

For the EUR / USD currency pair, the key levels on the scale of H1 are: 1.1769, 1.1750, 1.1719, 1.1696, 1.1669, 1.1650, 1.1613 and 1.1586. Here, the price is in correction from the descending structure and forms the potential for the top of July 13. The short-term upward movement is expected in the corridor of 1.1696-1.1719 and the breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.1750 and in the corridor of 1.1750 - 1.1769 is the consolidation.

The short-term downward movement is possible in the corridor of 1.1669 - 1.1650 and the breakdown of the last value will have to develop a downward structure. In this case, the target is 1.1613. We consider the level of 1.1586 to be a potential value for the bottom, after which we expect a rollback to the top.

The main trend is the downward structure of July 9, the formation of the potential for the top of July 13 in the correction.

Trading recommendations:

Buy: 1.1696 Take profit: 1.1716

Buy 1.1722 Take profit: 1.1750

Sell: 1.1667 Take profit: 1.1652

Sell: 1.1648 Take profit: 1.1615

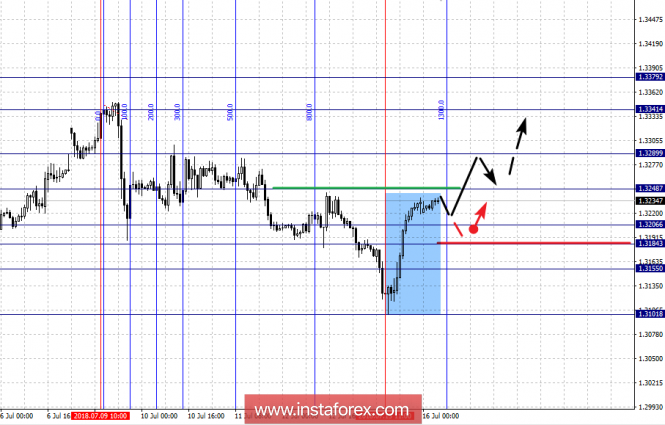

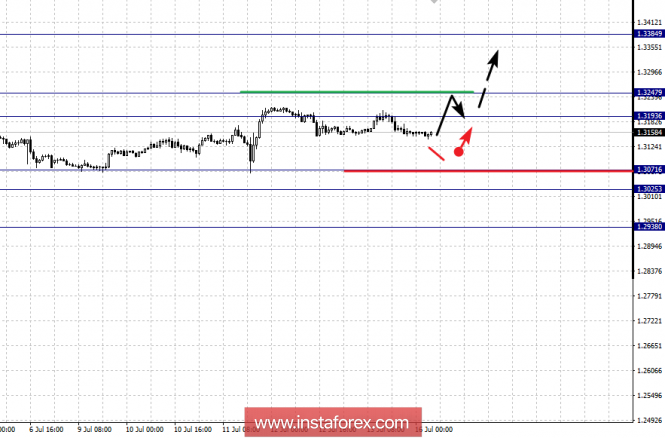

For the Pound / Dollar currency pair, the key levels on the H1 scale are 1.3379, 1.3341, 1.3289, 1.3248, 1.3206, 1.3184 and 1.3155. Here, the price is in correction and forms the potential for the upward movement of July 13. The continuation of the upward movement is expected after the breakdown of 1.3248. In this case, the target is 1.3289 and near this level is the consolidation of the price. The break of 1.3290 should be accompanied by a pronounced upward movement. Here, the target is 1.3341. The potential value for the top is the level of 1.3379, upon reaching which, we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 1.3206 - 1.3184 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3155 and the breakdown of this level will have a continuation of the downward structure. However, as the price leaves the 13th zone, the downward structure from July 9 is no longer relevant.

The main trend is the downward structure from July 9, the correction stage and capacity building on July 13.

Trading recommendations:

Buy: 1.3250 Take profit: 1.3287

Buy: 1.3292 Take profit: 1.3335

Sell: 1.3206 Take profit: 1.3186

Sell: 1.3182 Take profit: 1.3157

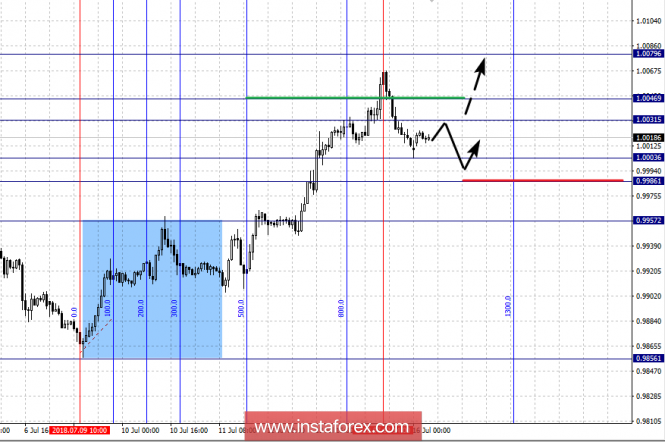

For the Dollar / Franc currency pair, the key levels on the scale of H1 are: 1.0079, 1.0046, 1.0031, 1.0003, 0.9986 and 0.9957. Here, we follow the development of the upward structure of July 9 and at the current time, the price is in correction. The short-term downward movement is possible in the range of 1.0003 - 0.9986 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9957 and to this level, we expect the initial conditions for the descending cycle to be formalized.

The short-term upward movement is possible in the range of 1.0031 - 1.0046. Hence, the probability of a turn downwards is high and the breakdown at 1.0046 level will allow us to count on the movement to the potential target of 1.0079, from which we expect a pullback.

The main trend is the upward structure from July 9, the correction stage.

Trading recommendations:

Buy: 1.0031 Take profit: 1.0044

Buy: 1.0048 Take profit: 1.0076

Sell: 1.0003 Take profit: 0.9990

Sell: 0.9984 Take profit: 0.9960

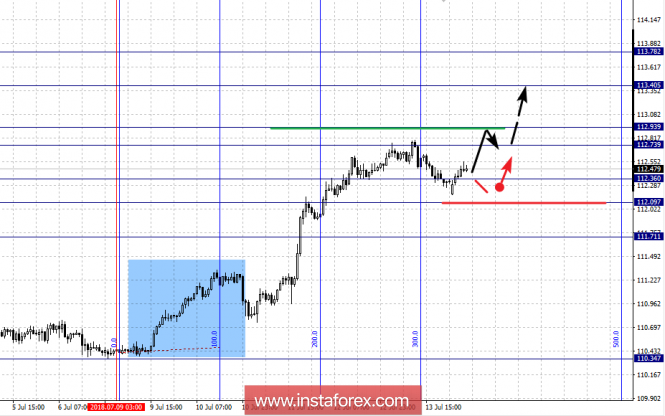

For the currency pair Dollar / Yen, the key levels on the scale of H1 are: 113.78, 113.40, 112.93, 112.73, 112.36, 112.09 and 111.71. Here, the price we follow the upward structure of July 9. The continuation of the upward movement is expected after the passage at the price of the noise range of 112.73 - 112.93. In this case, the target is 113.40 and near this level is the consolidation. The potential value for the top is the level of 113.78 (the probable date of reaching July 16 - 18), upon reaching this level, we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 112.36 - 112.09 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 111.71 and this level is the key support for the top.

The main trend: the upward structure of July 9.

Trading recommendations:

Buy: 112.95 Take profit: 113.40

Buy: 113.42 Take profit: 113.76

Sell: 112.34 Take profit: 112.12

Sell: 112.05 Take profit: 111.75

For the Canadian Dollar / Dollar currency pair, the key levels on the H1 scale are: 1.3384, 1.3247, 1.3193, 1.3071, 1.3025 and 1.2938. Here, the situation is still in an equilibrium state. The short-term upward movement is expected in the corridor of 1.3193 - 1.3247 and the breakdown of the last value should lead to the formation of initial conditions for the upward cycle. Here, the potential target is 1.3384.

The short-term downward movement is possible in the corridor of 1.3071 - 1.3025 and the breakdown of the latter value will lead to the formation of a potential for downward movement. Here, the target is 1.2938.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.3250 Take profit: 1.3380

Buy: Take profit:

Sell: 1.3025 Take profit: 1.2940

Sell: Take profit:

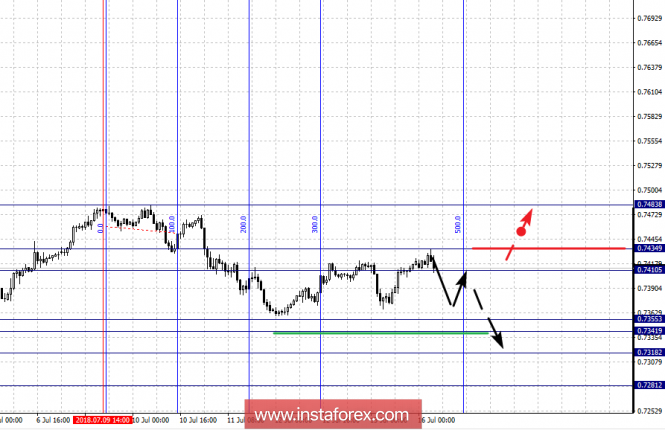

For the Australian Dollar / Dollar currency pair, the key levels on the scale of H1 are: 0.7434, 0.7410, 0.7355, 0.7341, 0.7318 and 0.7281. Here, we follow a small downward cycle from July 9 and at the moment, the price is in correction. More dynamic development of the situation can be expected after 15:00. The continued downward movement is expected after passing through the noise range of 0.7355 - 0.7341. In this case, the target is 0.7318. The potential value for the top is the level of 0.7281 (the probable date of reaching July 13)

The short-term upward movement is possible in the corridor of 0.7410 - 0.7434 and the breakdown of the last value will have to develop an ascending structure. Here, the potential target is 0.7483.

The main trend is the downward cycle from July 9, the correction stage.

Trading recommendations:

Buy: 0.7436 Take profit: 0.7465

Buy: 0.7411 Take profit: 0.7432

Sell: 0.7340 Take profit: 0.7320

Sell: 0.7316 Take profit: 0.7284

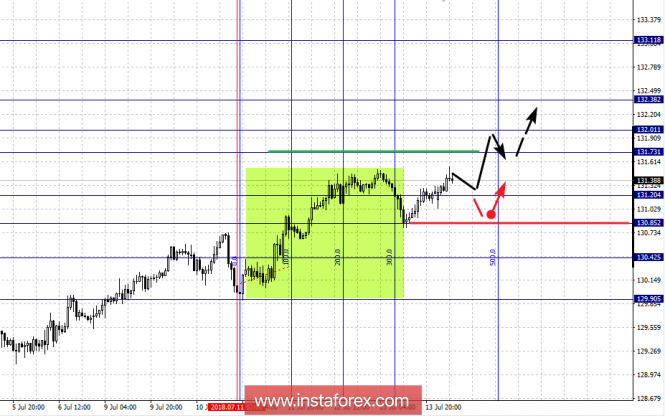

For the currency pair Euro / Yen, the key levels on the scale of H1 are: 133.11, 132.38, 132.01, 131.73, 131.20, 130.85 and 130.42. Here, we follow the local upward structure of July 11. The short-term upward movement is expected in the corridor of 131.73 - 132.01 and the breakdown of the last value will allow to expect movement to 132.38 level, near this consolidation level, and hence there is a high probability of withdrawal into correction. The potential value for the top is the level of 133.11 and the probable date of reaching it is July 17 - 18, upon reaching this level we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 131.20 - 130.85 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 130.42 and this level is the key support for the upward structure of July 11.

The main trend is a local structure for the top of 11 July.

Trading recommendations:

Buy: 131.73 Take profit: 131.00

Buy: 132.05 Take profit: 132.35

Sell: 131.15 Take profit: 130.90

Sell: 130.80 Take profit: 130.45

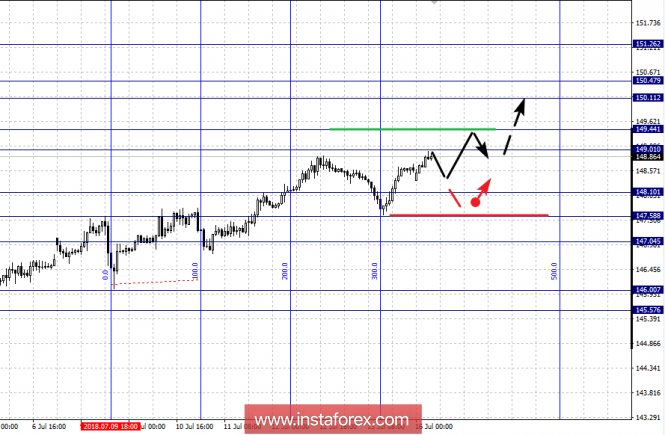

For the Pound / Yen currency pair, the key levels on the scale of H1 are: 151.26, 150.47, 150.11, 149.44, 149.01, 148.10, 147.58 and 147.04. Here, we follow the formation of the local upward structure of July 9. The continuation of the development of the upward structure of July 9 is expected after the breakdown of 149.01. The target is 149.44, from this corridor there is a high probability of leaving down. The break at level 149.45 should be accompanied by a pronounced upward movement. Here, the target is 150.11 and in the corridor of 150.11 - 150.47 is the consolidation and from here we expect a key turn down. The potential value for the top is the level of 151.26, the probable achievement of which is July 17 - 18.

The short-term downward movement is possible in the corridor of 148.10 - 147.58 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 147.04 and this level is the key support for the upward structure.

The main trend is a local structure for the top of July 9.

Trading recommendations:

Buy: 149.01 Take profit: 149.40

Buy: 149.48 Take profit: 150.10

Sell: 148.10 Take profit: 147.60

Sell: 147.55 Take profit: 147.07

The material has been provided by InstaForex Company - www.instaforex.com