Dear colleagues.

For the of EUR / USD pair, the price issued a pronounced structure for the top of June 28. For the GBP / USD pair, the price also forms a structure for the top of June 28. For the USD / CHF pair, we follow the downward structure of June 28. For the USD / JPY pair, we follow the upward structure of June 26. The development of this level is expected after the breakdown of 111.10. For the EUR / JPY, we follow the formation of the upward structure of June 28. For the GBP / JPY pair, the price forms an upward structure from June 28. The development of this level is expected after the breakdown of 146.70.

The forecast for July 2:

Analytical review of currency pairs in the scale of H1:

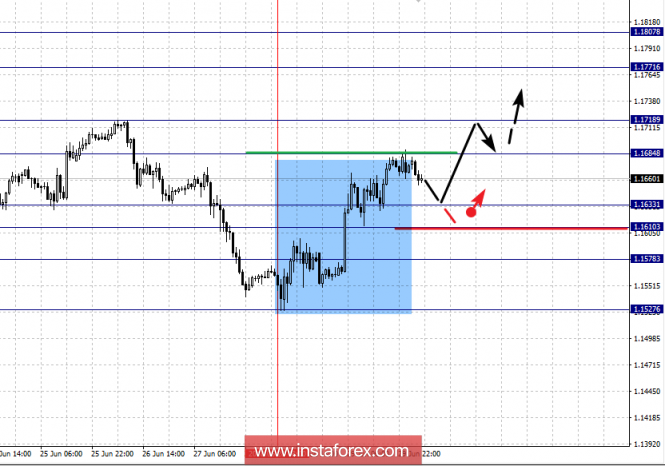

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1807, 1.1771, 1.1718, 1.1684, 1.1633, 1.1610 and 1.1578. Here, the price has issued an upward structure from June 28 for the development of a subsequent trend. The continuation of the movement towards the top is expected after the breakdown of 1.1684. In this case, the target is 1.1718. Near this level is the consolidation of the price. The breakdown at the level of 1.1718 should be accompanied by a pronounced upward movement. The target here is 1.1771. For the potential value for the top, consider the level of 1.1807. After reaching this level, we expect a rollback to the bottom.

Short-term downward movement is possible in the area of 1.1633-1.1610. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1578. This level is the key support for the upward structure.

The main trend is the initial conditions for the top of June 28.

Trading recommendations:

Buy: 1.1684 Take profit: 1.1715

Buy 1.1722 Take profit: 1.1770

Sell: 1.1631 Take profit: 1.1611

Sell: 1.1608 Take profit: 1.1580

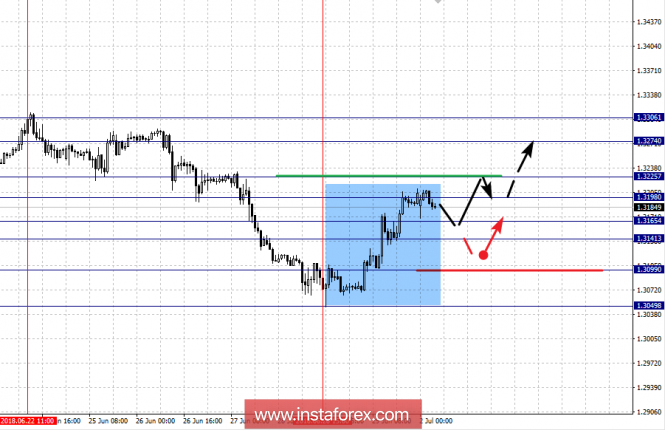

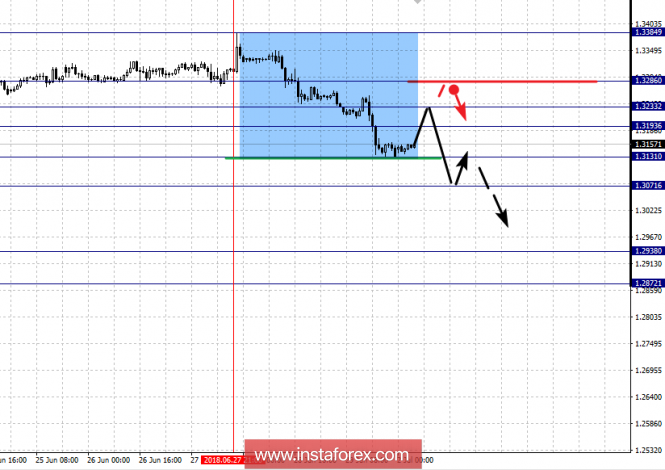

For the GBP / USD pair, the key levels on the scale of H1 are 1.3306, 1.3274, 1.3225, 1.3198, 1.3165, 1.3141 and 1.3099. Here, the price forms an upward structure from June 28. Short-term traffic to the top is expected in the area of 1.3198 - 1.3225. The breakdown of the last value should be accompanied by a pronounced movement towards the level of 1.3274. For the potential value for the top, consider the level of 1.3306. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 1.3165 - 1.3141. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3100. This level is the key support for the upward structure.

The main trend is the formation of the upward structure of June 28.

Trading recommendations:

Buy: 1.3198 Take profit: 1.3223

Buy: 1.3227 Take profit: 1.3272

Sell: 1.3165 Take profit: 1.3143

Sell: 1.3138 Take profit: 1.3105

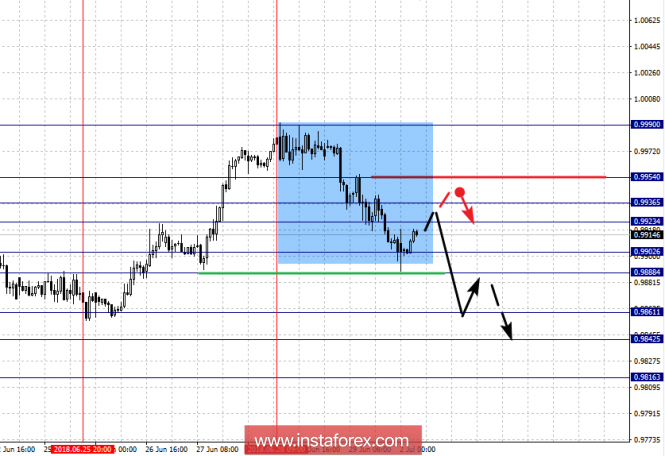

For the USD / CHF pair, the key levels in the scale of H1 are: 0.9954, 0.9936, 0.9923, 0.9902, 0.9888, 0.9861, 0.9842 and 0.9816. Here, we follow the formation of the downward structure from June 28. The continuation to the bottom is expected after passing by the price of the noise range at 0.9902 - 0.9888. In this case, the target is 0.9861. In the area of 0.9861 - 0.9842 is the consolidation of the price. For the potential value for the bottom, consider the level of 0.9816. Upon reaching this level, we expect a pullback to the top.

Short-term uptrend is possible in the area of 0.9923 - 0.9936. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9954. This level is the key support for the downward structure.

The main trend is the formation of a downward structure from June 28.

Trading recommendations:

Buy: 0.9923 Take profit: 0.9934

Buy: 0.9938 Take profit: 0.9952

Sell: 0.9888 Take profit: 0.9863

Sell: 0.9858 Take profit: 0.9845

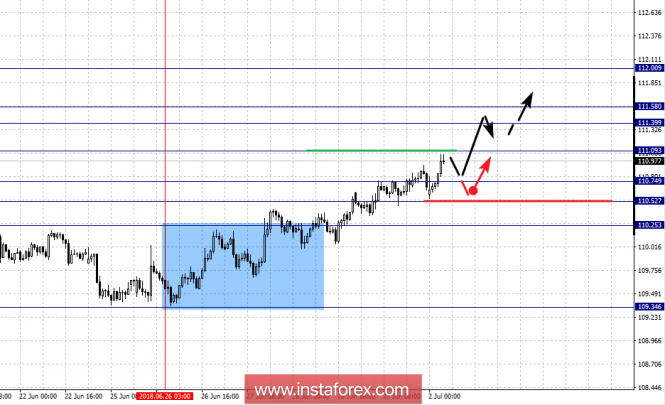

For the USD / JPY pair, the key levels on a scale are: 112.00, 111.58, 111.39, 111.09, 110.74, 110.52 and 110.25. Here, the continuation of the upward cycle from June 26 is expected after the breakdown of 111.10. In this case, the target is 111.39. In the area of 111.39 - 111.58 is the consolidation of the price. For the potential value for the top, consider the level of 112.00, After reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 110.74 - 110.52. The breakdown of the last value will lead to in-depth correction. Here, the target is 110.25. This level is the key support for the top.

The main trend is the upward structure of June 26.

Trading recommendations:

Buy: 111.10 Take profit: 111.36

Buy: 111.60 Take profit: 112.00

Sell: 110.73 Take profit: 110.52

Sell: 110.50 Take profit: 110.25

For the CAD / USD pair, the key levels on the H1 scale are: 1.3286, 1.3233, 1.3193, 1.3131, 1.3071, 1.2938 and 1.2872. Here, we follow the formation of a downward structure from June 27. Short-term downward movement is expected in the range of 1.3131 - 1.3071. The breakdown of the last value will lead to the development of a pronounced movement towards the bottom. Here, the target is 1.2938. For the potential value for the bottom, consider the level of 1.2872. From this level, we expect a pullback to the top.

Short-term uptrend is possible in the area of 1.3193 - 1.3233. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3286. This level is the key support for the bottom.

The main trend is the formation of a downward structure from June 27.

Trading recommendations:

Buy: 1.3193 Take profit: 1.3231

Buy: 1.3235 Take profit: 1.3285

Sell: 1.3130 Take profit: 1.3073

Sell: 1.3068 Take profit: 1.2940

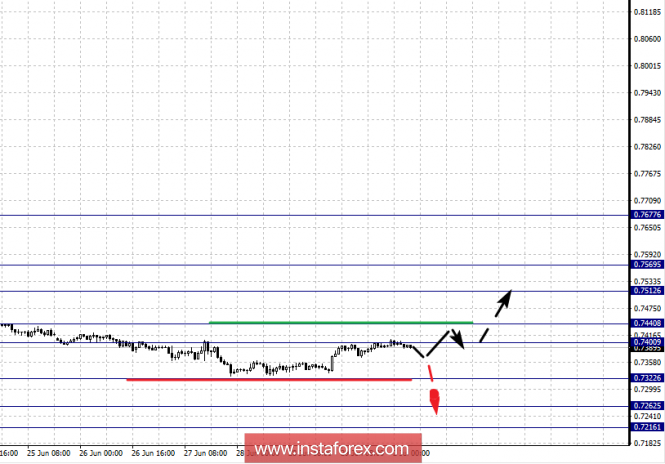

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7569, 0.7512, 0.7440, 0.7400, 0.7322, 0.7262 and 0.7216. Here, we continue to follow the downward cycle from June 6. The continuation of the movement towards the bottom is expected after the breakdown of the level of 0.7322. Here, the target is 0.7262. In the area of 0.7262 - 0.7216 is the consolidation of the price and from here, we expect a key turn to the top.

Consolidated movement is possible in the area of 0.7400 - 0.7440. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7512. For the initial conditions for the upward cycle, we expect to reach 0.7569.

The main trend is the downward cycle from June 6, the correction stage.

Trading recommendations:

Buy: 0.7442 Take profit: 0.7510

Buy: 0.7514 Take profit: 0.7566

Sell: 0.7320 Take profit: 0.7264

Sell: 0.7260 Take profit: 0.7218

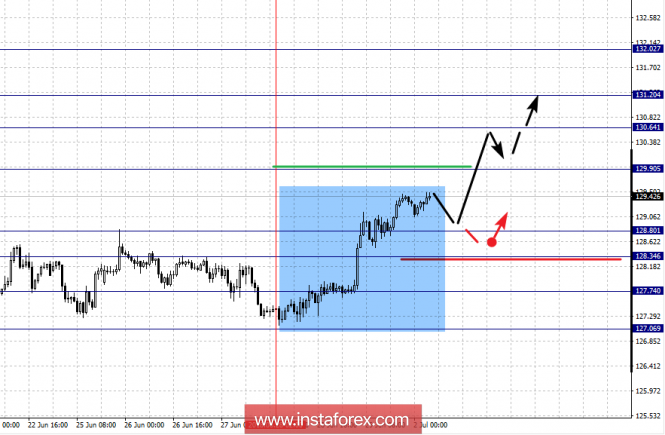

For the of EUR / JPY pair, the key levels on the scale of H1 are: 132.02, 131.20, 130.64, 129.90, 128.80, 128.34, 127.74 and 127.06. Here, the price has issued a pronounced structure for the upward movement of June 28. The continuation of traffic to the top is expected after the breakdown of 129.90. In this case, the target is 130.64. In the area of 130.64 - 131.20, we expect short-term upward movement, as well as the consolidation of the price. For the potential value for the top, consider the level of 132.02. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 128.80 - 128.34. The breakdown of the last value will lead to in-depth correction. Here, the target is 127.74. This level is the key support for the upward structure of June 28.

The main trend is the upward structure of June 28.

Trading recommendations:

Buy: 129.90 Take profit: 130.60

Buy: 130.66 Take profit: 131.20

Sell: 128.80 Take profit: 128.38

Sell: 128.30 Take profit: 127.80

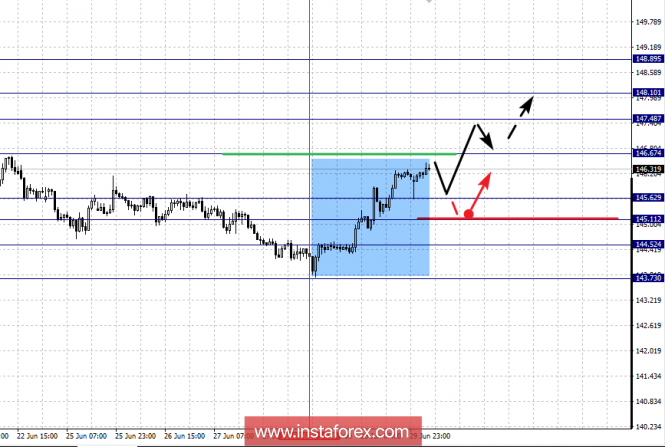

For the GBP / JPY pair, the key levels on the scale of H1 are: 148.80, 148.10, 147.48, 146.67, 145.62, 145.11 and 144.52. Here, the price forms an upward structure from June 28. The continuation of the movement towards the top is expected after the breakdown of 146.67. In this case, the target is 147.48. In the area of 147.48 - 148.10 is the consolidation of the price. For the potential value for the top, consider the level of 148.89. After reaching this level, we expect a rollback to the bottom.

Short-term downward movement is possible in the area of 145.62 - 145.11. The breakdown of the last value will lead to in-depth correction. Here, the target is 144.52. This level is the key support for the upward structure of June 28.

The main trend is the formation of the upward structure of June 28.

Trading recommendations:

Buy: 146.68 Take profit: 147.45

Buy: 147.50 Take profit: 148.10

Sell: 145.60 Take profit: 145.14

Sell: 145.10 Take profit: 144.55

The material has been provided by InstaForex Company - www.instaforex.com