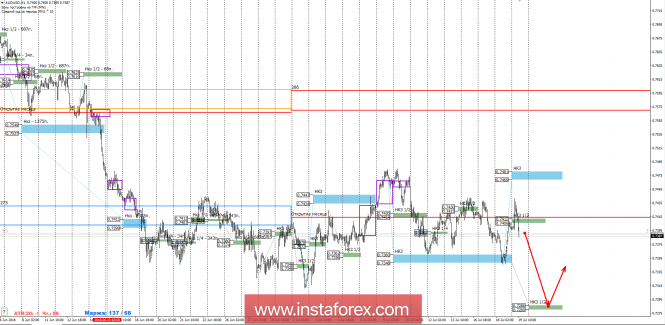

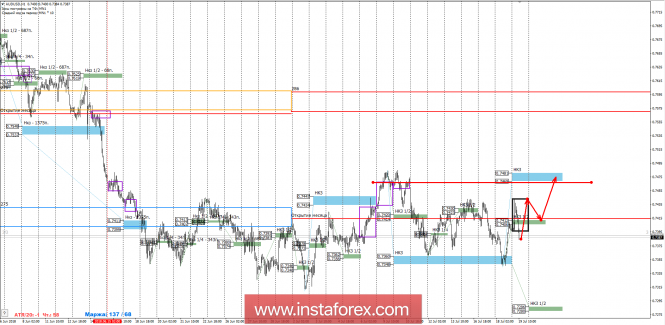

Today, there was a test NCP 1/2 0.7412-0.7406, which allows you to consider sales, the purpose of which will be yesterday's low. The downward model will remain a priority as long as US sessions close below the control zone.

At the test zone of resistance zone NCP 1/2 0.7412-0.7406 there was a sufficiently large take-off, which indicates the need to search for a pattern for sale. Yesterday's US session closed below the zone. This speaks in favor of a depreciation at the end of this week. The first goal of the fall will be a weekly short-term fault of 0.7360-0.7348, where partial fixation is required. The main goal is the NCP 1/2 0.7286-0.7280, which is already a medium-term goal and will become active at the close of the American session below the level of 0.7348.

It is important to note that in the middle of June a complex flat model is formed, where the main levels of support / resistance are monthly extremes, when approaching to which it is required to withdraw part of the position from the market.

To form a reversal model, you need to close today's US session above the level of 0.7412. This will open the way for growth to the weekly short-term fault of 0.7481-0.7469, which will act as a determining resistance for medium-term growth. In the conditions of a protracted flatten, it is necessary to consider the possibilities of getting out of it and fixing it with further movement in the direction of breakdown. The downward movement still remains a priority, which makes the probability of updating the monthly minimum equal to 70%.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com