AUD/USD has been quite non-volatile and impulsive, following the bearish bias. As a result, the pair is trading below 0.7350 with a daily close. USD has been the dominant currency in the pair since the recent rate hike by the US Fed from 1.75% to 2.00% that ecouraged a further USD strength against AUD.

This week, Australia posts no macroeconomic reports. Next week, the Reserve Bank of Australia is due to make a policy decision. The benchmark cash rate is widely expected to be unchanged at 1.50%. Moreover, Australia's regulator is going to make a rate statement on the same day which is expected to shed light on a rate hike. Till now, the central bank hasn't dropped any hints about monetary tightening in Australia. However, global investors are betting on the more hawkish stance of RBA in the short term.

On the USD side, today Final GDP report was published with a decrease to 2.0% which was expected to be unchanged at 2.2%, Unemployment Claims increased significantly to 227k from the previous figure of 218k which was expected to be at 220k, and Final GDP Price Index was increased to 2.2% which was expected to be unchanged at 1.9%. Moreover, today Natural Gas Storage report is going to be published which is expected to decrease to 73B from the previous figure of 91B. Besides, FOMC Member Bostic is going to speak today who was quite optimistic in his latest speech. Amid escalating trade tensions between the US and its trade partners, his speech is expected to contribute to further USD gains today.

USD is expected to extend its gain further in the long term. As for a short- and medium-term scenario, AUD is expected to gain certain momentum ahead of the Cash Rate report, which is due next week.

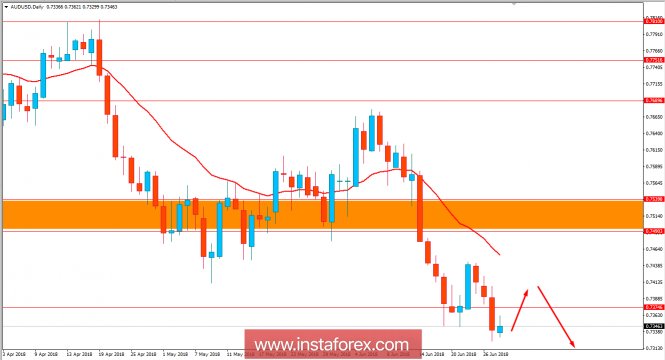

Now let us look at the technical view. The price is currently quite indecisive and showing certain bullish pressure below 0.7350 area after a daily close recently. The dynamic level of 20 EMA has been quite far from the current price position which is expected to attract the price towards the mean leading with retracement. As the price remains below 0.75 area with a daily close, the bearish bias is expected to continue.