The US dollar, as part of the correction, continues to decline against most of the world's currencies. Despite the growth of PMI ISM in the services sector in May to 58.6p, which exceeded the forecast, the focus of the market is concentrated primarily on geopolitical news and the situation in the likely escalation of trade wars.

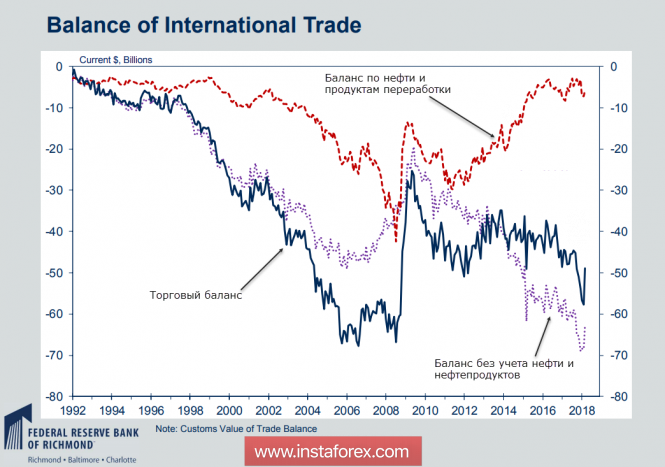

It should be noted that, despite Trump's efforts, the US trade balance still looks terrible. Despite a rather noticeable rebound in March from 57.7 billion deficit to -49.0 billion, this result is not a sign of stabilization or improvement of the situation in general. The fact that the trade deficit is held higher than in 2006/09 is due to the exceptionally slate boom that was launched under Obama.

The US, having significantly increased oil production, reduced its dependence on imports such as oil at the peak of prices in 2008 added up to $ 40 billion of trade deficit per month, so the overall deficit set record lows. The fall in oil prices and the increase in oil production have made it possible to reduce this component of the trade balance to almost zero and only then can the deficit be kept within acceptable limits.

If we exclude oil and oil products from the balance (the purple line on the chart), then we can see a steady decline starting from 2010. By January 2018, the deficit reached 69 billion, and the rollback in February-March is just a correction from the absolute minimum and is not a sign of improving the overall situation.

Trump's desperate attempts to put pressure on the main US trading partners to break the growth trend of the trade balance is not a whim, but a necessity. If it fails to do so, the trade deficit will continue to grow, which will inevitably lead to an increase in the budget deficit with all the ensuing consequences including the need to cut costs and reduce the standard of living of the population against the backdrop of an inevitable recession.

Therefore, the trade war between the US and the rest of the world is inevitable, and how it will end is not yet clear. All the US trading partners - Japan, the European Union Canada, Mexico - have expressed their determination to challenge US actions in the WTO and to introduce counter measures to maintain the status quo. As for China, the agreements reached some time ago did not hold out for a week. On May 29, Trump announced the first tariffs of 50 billion. On June 15, a specific list of goods falling under the tariffs will be announced, and with a high degree of certainty, it can be asserted that it will be directed against the "Strategy 2025" which is China's main plan for the development of the country.

In other words, we are talking about restraining China's economic development. It is clear that this can only end with a trade war.

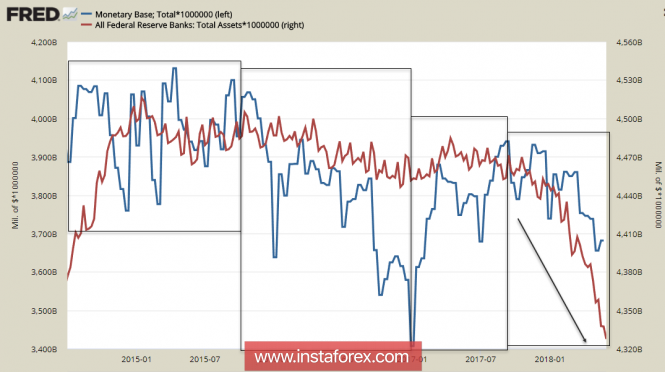

At the same time, one must bear in mind that the era of the dollar deficit is rapidly approaching. The Fed turns off the balance, and the pace of this process is accelerating, and taking into account the correlation of the balance and the monetary base, it is expected to reduce it in the coming months.

Along with the planned increase in the rate at the FOMC meeting on June 14 and at least one more increase this year, the world risks to face the situation of the dollar deficit on one hand and its appreciation on the other hand. This will make servicing both world trade and existing loans all the more expensive.

These measures will inevitably lead to the value of the dollar. If the US manages to keep it as the main unit of account, then a strong dollar will push the whole world to a recession, but it will allow the US to remain as the dominant economic force of the planet. Apparently, the strategy of the US financial authorities is precisely this. However, the resistance to "tariff expansion" is growing all over the world, and at the moment, there is no indication that Trump will manage to get what he wants, and under all other scenarios the dollar will begin to weaken due to a reduction in the scope of distribution.

Before the G7 meeting on June 8-9, the dollar will weaken. Corrective growth in the EURUSD can continue to 1.1810 in the next day and 1.1880 before the end of the week. The pound can reach to 1.3450 today with a target at 1.3560. Gold is likely to grow until the end of the week and there will be another attack of bears on oil quotations.

The material has been provided by InstaForex Company - www.instaforex.com