Eurozone

The completed week did not bring the euro a single reason to resume growth. Preliminary data on consumer inflation in April were noticeably worse than expected, retail sales growth slowed to 0.8% year-on-year in March, and business activity, according to Markit estimates, is slowing across the entire spectrum of the economy. In the service sector, the PMI index declined in April from 55.0 points to 55.7 points, a marked decrease in activity is observed in Germany.

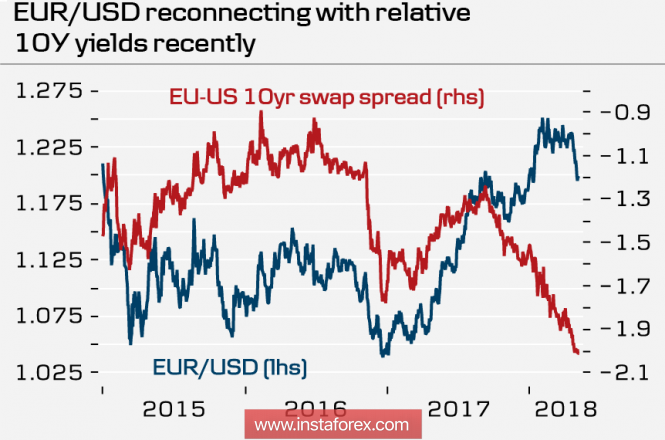

The yield spread steadily grows in favor of the dollar, and if we compare its dynamics with the EURUSD rate, we can clearly see the potential for a drop down to 1.05 by the end of this year.

The Fed slightly changed the inflation estimate in its commentary following the recent meeting of the FOMC and, clearly, expects its acceleration, it allows confidently to expect at least two more rate increases this year, while official representatives of the ECB carefully push back the first increase for the second half of 2019. And they link this move with the start with the complete completion of the asset repurchase program, which, incidentally, does not have a clear timeframe.

The coming week is unlikely to allow the euro to stop its decline. The week will be poor on macroeconomic reports, as nothing deserves attention except the publication of reports on industrial production and trade balance of Germany on Tuesday, and the markets will focus on general macroeconomic trends than on intra-European factors. Rising oil prices will put pressure on production growth rates and worsen the foreign trade balance, the zero result of trade talks between the US and China will increase global demand for the dollar.

The euro was fixed below the level of the 200-day average and below the psychological mark of 1.20, in the bear perspective, the bear will push the price to support level of 1.1710.

United Kingdom

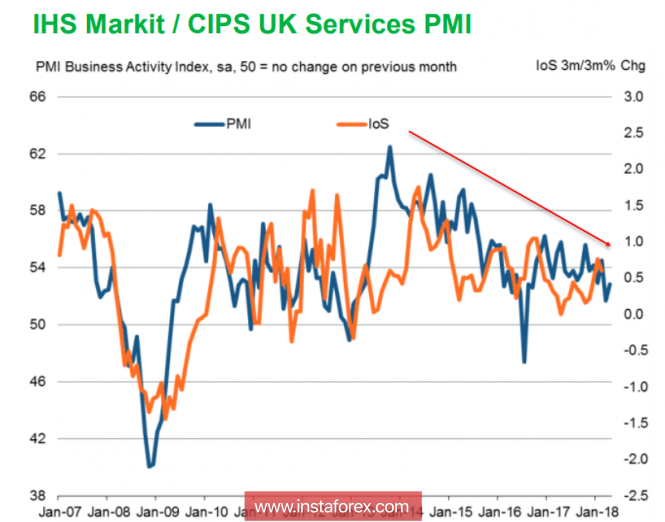

The index of business activity in the services sector is key to understanding trends in the British economy. In April it showed 52.8p - it is slightly higher than 51.7p a month earlier, but at the same time worse than expectations. The general trend of the second half of 2014 is not in doubt:

During a meeting on Thursday, the Bank of England will assess whether the weakness in the country's economy is temporary or has deeper reasons. Until recently, the markets were confident that at the May meeting the regulator would raise the rate based on confidence in a long-term recovery, but recent data indicate that there may not be an increase.

GDP growth slowed to 1.2%, business activity declined in all sectors, the consumer confidence index was firmly entrenched in negative territory, and the core inflation in March fell to 2.3%, and this is the annual minimum. There are no signs of "a sure recovery," the forecasts for the rate increase have already seriously shaken after the recent comments of BOE Governor Mark Carney.

The pound tested the level of 1.35, and this is in view of the fact that while the chances of raising rates remain quite high. If the Bank of England refrains from this step, then the pound may decrease as a reaction up to 1.30, as there will be no reasons for growth. The rate increase will have a temporary effect, and the decline will continue, but more smoothly, in this case a corrective growth up to 1.3705 is possible, followed by a downward turn.

Oil

Oil continues to grow strongly against the backdrop of geopolitical risks associated with potential tightening of US sanctions against Iran. Achieving a level of $ 75 bpd, which until recently was considered absolutely satisfactory to all participants in the OPEC + deal, as risks show intermediate results, is now not an ultimate goal. Appetite comes with consumption, and more voices that advocate a balance of 80-85 dollars per barrel, as it turned out that many oil-producing countries can not balance themselves even at this price level.

The situation around Iran should get affirmation before May 12, before this time quotes will be highly likely to continue growing.

The material has been provided by InstaForex Company - www.instaforex.com