AUD/USD was being dominated by USD since the price bounced off the 0.78 area with a daily close which leads the price to be non-volatile with the bearish gains. This week RBA Statement and AUD Cash Rate report was published with an unchanged value of 1.50% which did help the currency to gain certain momentum against USD in the process.

Today AUD AIG Service Index report was published with decrease to 55.2 from the previous figure of 56.9, Trade Balance report was published with an increase to 1.53B from the previous figure of 1.35B which was expected to decrease to 0.68B and Building Approvals report also showed significant increase to 2.6% from the previous negative value of -4.2% which was expected to be at 1.1%. The positive economic reports did help AUD counter impulsively against the USD non-volatile bearish trend today, which is expected to lead to further bullish momentum in the pair.

On the USD side, today USD Non-Farm Productivity report is going to be published which is expected to increase to 0.9% from the previous value of 0.0%, Prelim Unit Labor Cost is expected to increase to 3.1% from the previous value of 2.5%, Unemployment Claims report is expected to increase to 225k from the previous figure of 209k and Trade Balance report is expected to have less deficit by increasing to -50.0B from the previous figure of -57.6B. Additionally, USD Final Services PMI report is going to be published which is expected to be unchanged at 54.4, ISM Non-Manufacturing PMI is expected to decrease to 58.1 from the previous figure of 58.8, Factory Orders are expected to increase to 1.3% from the previous value of 1.2% and Natural Gas Storage report is expected to show an increase to 47B from the previous negative figure of -18B.

To sum up, USD economic reports forecasts are quite mixed in nature whereas AUD has already proven to have better economic reports results in comparison, where certain mixed results on the USD on the upcoming economic reports are expected to lead to further gain on the AUD side in the coming days. As of the current scenario, AUD is expected to have an upper hand over USD despite the upcoming economic reports results to be published.

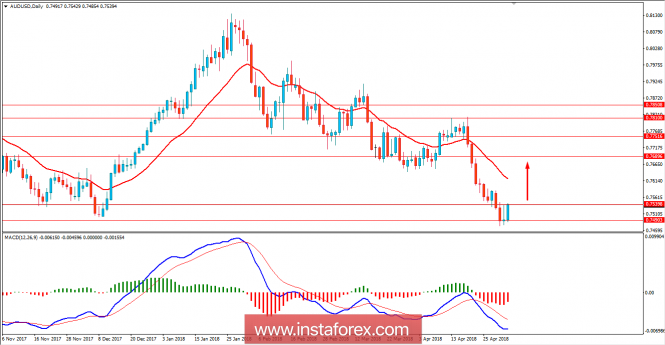

Now let us look at the technical view. The price is currently residing at the edge of 0.7550 area from where it is expected to push higher towards 0.77-0.7750 area in the coming days. In the intraday charts, certain Bullish Divergence has been observed forming which is expected to increase the probability of further bullish pressure in the process. As the price remains above 0.75 area with a daily close, the bullish bias is expected to continue further.