Eurozone

This week will be poor for macroeconomic indicators, which can change the prospects for the euro. On Tuesday, the ZEW Institute will present an economic sentiment index for the month of April. Most similar studies indicate a slowdown in activity.

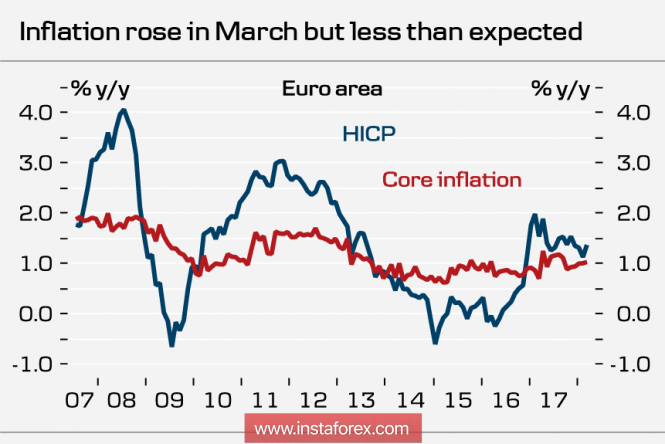

On Wednesday, there will be data on consumer inflation for the month of March. Inflation is already slowing down throughout this year, giving the ECB the opportunity to evade the curtailment of the incentive program and, according to forecasts, the market will not see any positive changes on Wednesday.

The rhetoric of the ECB leadership against the backdrop of a slowdown in the euro zone economy is becoming more mild. With the rate at which the forecasts are changing, the first increase has been postponed until Q3 2019. Perhaps the markets will be shaken by the speech of the chief economist of the ECB Praet or at least the players will need benchmarks that are presently absent.

The euro continues to trade in a range that tends to narrow and is currently in an unstable equilibrium situation. In the first days of the week, trading will take place within the area of 1.2200 - 1.2470, without the obvious advantage of any of the parties.

United Kingdom

The British pound finished the week with growth, based on the increasing probability of a rate hike by the Bank of England. Despite weak GDP growth, inflation, and the labor market's status, the BoE is given an opportunity that it will most likely take advantage of in order to gain an additional argument in the battle for financial flows after the country leaves the EU.

The pound will receive several rather important signals this week. The threat of a rate hike by the Bank of England in May compels us to pay more attention to the key parameters of the economy, so the report on the labor market on Tuesday will cause increased interest. The forecast is positive. The average wage is expected to increase and the number of applications for unemployment is reduced. The data may increase the likelihood of an increase in the rate and lead to an increase in the pound.

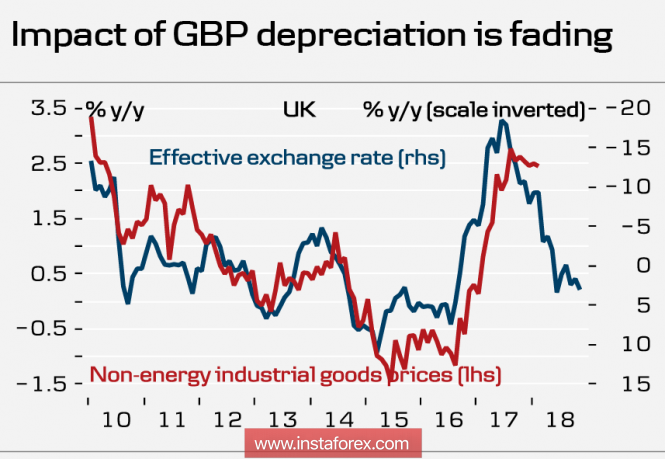

On Wednesday, the report on inflation for the month of March will be published. The forecasts are neutral but some slowdown in price growth by the market is almost ignored, as the influence of the weak pound is dying out.

Technically, the pound looks more than confident. The probability of updating the three-year maximum set in January is quite high. The breakthrough of the wedge opens the way to the level of 1.4340 and further to the upper boundary of the rising channel at 1.44.

Oil

Oil continues to trade above three-year lows, focusing on the main indicator, which affects quotes on the balance of supply and demand. The efforts of OPEC + give the result. The IEA already predicts that in May, the balance in the market will finally be reached. The commercial reserves of the countries of the Organization for Economic Cooperation and Development fell in March to 2.841 billion barrels, and in May, according to the IEA, it will approach the average for 5 years.

Traders practically do not pay attention to the reports of Baker Hughes, which show stable growth of active drilling rigs and should somewhat cool the demand, neither on API commercial inventory reports. Its role is also played by the complication of the geopolitical situation after the US missile struck against targets in Syria and the production in Venezuela sharply declined.

Support for Brent is at the level of 68.50, within the correction it is possible to decrease to this level, but strategically the prices are aimed at 80 dollars per barrel. This can be reached in the perspective of the month.

The material has been provided by InstaForex Company - www.instaforex.com