USD has been the dominant currency against CHF recently which has led the price to be non-volatile with the bullish gains despite downbeat economic reports published in the US recently. Ahead of the upcoming macroeconomic reports on the USD side today, CHF has been pushing the price lower with the support of positive economic reports. Today, Switzerland's Foreign Currency Reserves report was published with an increase to 738B from the previous figure of 732B. The positive economic report encouraged some gains on the CHF side but it is expected to be quite temporary as US reports on the labor market could provide USD with solid support. Today, US Average Hourly Earnings report is going to be published which is expected to increase to 0.3% from the previous value of 0.1%, Non-Farm Employment Change report is expected to decrease to 188k from the previous figure of 313k, and Unemployment Rate is expected to decrease to 4.0% from the previous value of 4.1%. As for the current scenario, USD is expected to gain more momentum over CHF as the expectation of the high impact economic reports are quite optimistic. So, better than expected economic reports are sure to push the price much higher in the coming days.

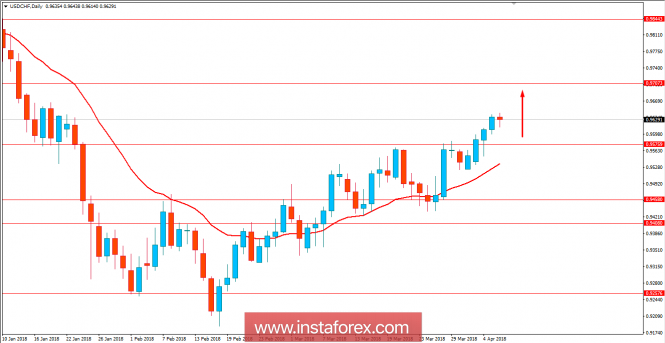

Now let us look at the technical view. The price is currently residing above 0.96 price area from where it is expected to proceed higher towards 0.97 and later towards 0.9850 area. The bullish trend is still non-volatile and expected to be impulsive in the coming days as well. As the price remains above 0.94 area, the bullish bias is expected to continue.