NZD/USD is currently quite impulsive amid the bullish pressure which created extreme volatility after the recent break above the 0.7250 price area, broken recently as a support. Ahead of the ANZ Business Confidence this week which is one of the main indicator of economic health, NZD is quite strong in nature which is expected to continue further in the coming days. Today, New Zealand's Trade Balance report was published with an increase to 217M from the previous figure of -655M which was indeed a remarkable gain as the expectation was negative at -100M. The positive Trade Balance report helped the currency to gain impulsive momentum over USD while USD was struggling to sustain its gains due to recent Rate Hike backfire. On the USD side, today FOMC Members Dudley and Mester are going to speak that is expected to inject some volatility in the market ahead of the daily close. Any positive result today may lead to a certain gain on the USD side as well. As for the current scenario, most of the odds are set against USD and in favor of NZD for the short term. Until USD comes with better economic readings, NZD is expected to continue its bullish impulsive gains in the future.

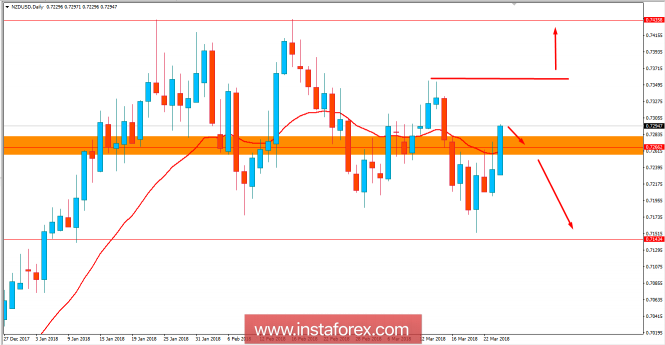

Now let us look at the technical view. The price is currently residing above 0.7250 price area which is expected to retrace towards the area and proceed lower in the coming days. The pair is currently quite volatile but the bearish squeeze is still quite intact despite the recent impulsive bullish pressure. As the price remains below 0.7350 with a daily close, further bearish pressure is expected in this pair with a target towards 0.7150 in the coming days.