Eurozone

On Thursday, the ECB meeting ended based on expectations, as the interest rates maintained at the zero level. While ECB head Mario Draghi did not make a traditional remark about the possibility of continuing the program of purchasing assets after the completion of the current period of decline.

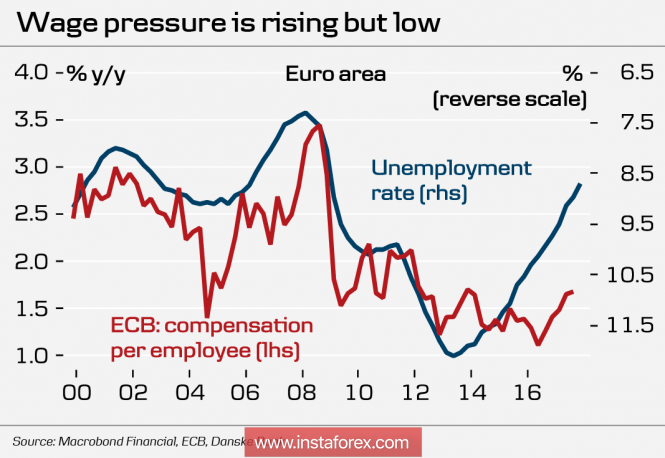

The single European currency had a slight reaction towards the meeting results, nor to the press conference of Draghi because he did not mention anything new for himself. The position of the ECB remains cautious, and the economy is growing steadily. But the growth rate of wages remains low, which does not indicate a possible increase in inflation.

Significantly, more markets are concerned about the development of the trade duties situation. US President Donald Trump announced possible exceptions for Mexico and Canada as US partners for NAFTA but Trump did not mention anything about the preferences for Europe. The new tariffs will be in effect after March 23rd, Brussels is currently in trouble since it needs to resolve the deadline for these two important issues, Brexit and the US response.

Euro unexpectedly appears under strong pressure, which restrained further growth in the coming week. It is possible that the decline towards the support of 1.2150 is expected on Monday against the background of the rapid growth of currency risks for the euro area.

United Kingdom

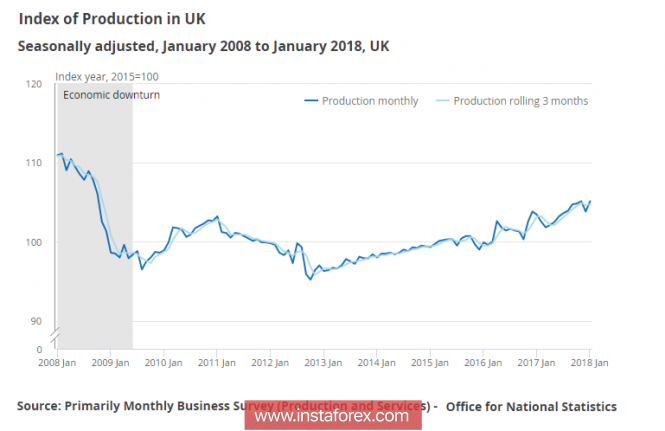

Generally, the main macroeconomic frameworks changed last week in accordance with the forecasts, as the pound responded sluggishly, and the players do not have a clear position in the trend direction.The quarterly inflation forecast from the Bank of England was 2.9% which further coincided with the forecasts, the growth rate of GDP under the NIESR version is 0.3% for the last quarter, which is also fully coincided with the experts' forecast. Housing prices have not changed, and the dynamics of industrial production is moderately positive.

The pound is gradually losing its main growth driver in the previous months, Brexit talks. Last week, the EU unveiled its negotiating program, and it did not please the queen's subjects at all. According to the EU, one must stand by the positions of preserving the single market without any exceptions in order to successfully complete them, as insisted by the UK. The EU does not intend to give an advantage to the other side at its own expense, it is clear from the document itself, providing the UK to reconsider its position on leaving the customs union and the single market.

The document also contains a tough position on the main issue concerning the access of the British banks to the EU market, which could limit the circulation of the pound and lead to a reorientation of financial flows.

The signing will take place at the EU summit on March 22-23, while the pound has no direction and continues to find for it, most likely, this week.

As of today, the pound is trading near the equilibrium price is formed by a "wedge" pattern with the top on January 25. The time has come. the economic forecast from the Ministry of Finance. This could possibly contain unexpected conclusions for the market regarding the frameworks of monetary stimulus.

Oil

Prices of oil did not ignore the report on the US labor market, showing a resumption of growth simultaneously with the growth of stock markets. The expected decrease to the February lows did not happen, as the growth in the US production can be compensated by the demand growth that will keep the overall balance above the forecast level.

According to Baker Hughes, the number of new drilling rigs has increased by 3 percent last week. The conference in Houston generated more questions than answers, the talks between OPEC representatives and the American slates has no apparent result, but both sides are extremely interested in maintaining positive price dynamics and look for some forms of cooperation.

The CFTC report showed that speculators reduce the total shorts and expect the growth of quotes to recover to the level of $ 70 / bbl. this week.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com