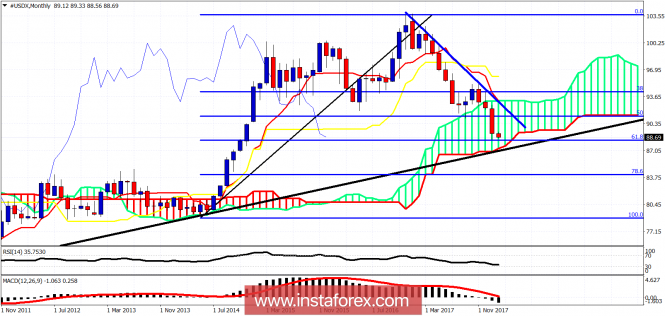

The Dollar index continues to trade in a bearish trend. Price got rejected at the short-term resistance yesterday and is making new lows. I expect the January 25th low to be broken soon. Maybe today, maybe next week after a bounce, but overall the chances favor the index to go towards 87.

Black rectangle - resistance

The Dollar index remains in a bearish trend. Price is below both the tenkan- and kijun-sen indicators. Price got rejected at the cloud resistance yesterday and made new lower lows. Support is at 88.50. Resistance is at 89.20. Short-term trend changes only above 89.60.

The monthly chart of the Dollar index shows it inside the monthly Kumo (cloud) challenging the long-term black trend line support. This support trend line is at the same level with the lower cloud boundary at 86.80. Price is also at the 61.8% Fibonacci retracement of the rise from 2013. This is long-term support area. Short-term traders should remain bearish as long as price is below 89.60, while longer-term traders should be patient for a bounce soon.

The material has been provided by InstaForex Company - www.instaforex.com