USD/CHF has recently retested the 0.9450 price area with a daily close which is expected to push the price much lower in the coming days. The recent retracement was due to the positive USD Employment Change report published this month which resulted to an impulsive bullish pressure after getting dominated by bears for a certain period of time. The weakness of CHF can also be the result of decreasing Foreign Currency Reserve to 731B from the previous figure of 744B. Today, CHF Unemployment Rate report was published with an unchanged value, as expected, at 3.0% which did not quite supported the CHF gains over USD by now. On the other hand, USD has been quite positive with the Unemployment Claims report which was published with a decrease to 221k from the previous figure of 230k. The decrease in Unemployment Claims was quite as expected as of the recent increase in Non-Farm Employment Change figure. Today, USD Final Wholesale Inventories report is going to be published which is expected to be unchanged at 0.2% and to have a minimal impact on the gains of USD for the coming days. As of the current scenario, USD is currently quite strong fundamentally than CHF which did reflect the market pretty well by now. Decrease in Foreign Reserve was a big hit for CHF this week, whereas USD was already strong due to the recent Employment Change. Until CHF comes up with positive economic report results in the coming days, USD is expected to sustain its gains and may lead to further bullish pressure in the future.

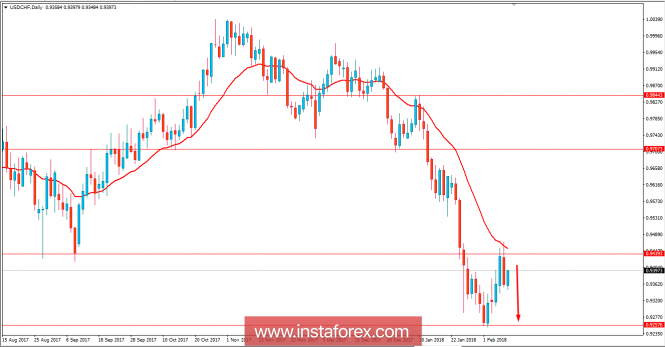

Now let us look at the technical view. The price has recently retested the 0.9450 price area and dynamic level of 20 EMA as a resistance. The price is currently expected to proceed lower towards the 0.9250 area if the price manages to remains below 0.9450 with a daily close in the coming days. As the price remains below 0.9450, the bearish bias is expected to continue further.