The correction of oil has been brewing for a long time, and its catalysts have come from the stock market increased volatility, a stronger dollar and a report on the growth of production in the United States to 10.038 million b / s in November, which is the maximum since 1970. In the past few months, investors have forgotten about the tug of war between OPEC and American corporations, which from August 2016 to September 2017 laid the foundation for long-term consolidation. The US Energy Information Administration recalled it.

The states returned to the list of three superpowers capable of increasing the production of black gold above the psychologically important level of 10 million b / s. They compete with Russia and Saudi Arabia in a comfortable environment: Moscow and Riyadh are involved in OPEC and other countries' deal to limit production by 1.8 million b / s by the end of 2018. The cartel managed to achieve the main thing: The achieved perennial highs from 2 years ago, Brent and WTI soared more than twice. And the current prices are quite satisfied with the Americans. Are their corporations able to fill the market with oil, having previously hedged the price risks? Not sure.

Despite the fact that shale mining in 2018 is likely to repeat its success in 2011-2014 and expand by 1 million b / s, it will not be enough to cover the impressive global demand at 1.7 million b / s. Even if you add Brazil and Canada to the States developing super-deep deposits of tar sands. At the same time, the weak US dollar will continue to support the "bulls" for Brent and WTI.

According to Capital Economics, in December-January, half of the rise in oil prices can be explained by lowering the USD index to three-year lows. Black gold is quoted in dollars, so the vulnerability of the latter makes the work of Brent and WTI buyers much easier. The current correction of the "American" looks like a temporary phenomenon. The further improvement of macroeconomic statistics in the US will restore confidence in the bright future of the global economy and will force investors to buy other currencies on the expectations of monetary policy normalization by central banks-competitors of the Fed. At the same time, hopes for an increase in global oil demand will grow. Seasonal decline of the latter within the US has become another factor in the recoil of black gold.

Pig fans Brent and WTI have put US stock indexes, frightened by aggressive monetary restriction of the Fed after the release of strong statistics on the US labor market in January.

Dynamics of DowJones and WTI

Source: Bloomberg.

Thus, it is premature to talk about a break in the uptrend in oil. At the same time, Goldman Sachs' forecast of Brent growth to $ 82.5 per barrel over the next 6 months still does not look like a utopia.

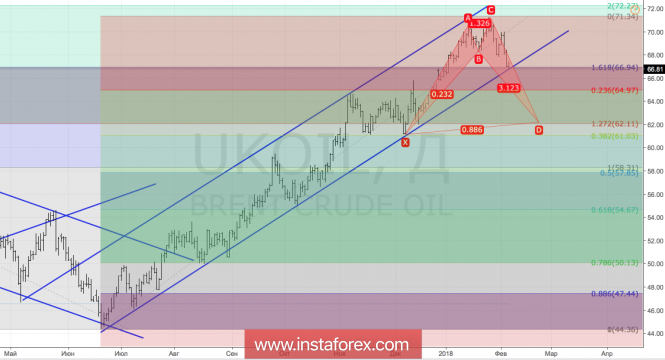

Technically, the further fate of the North Sea variety will depend on the test of the lower boundary of the upward trading channel. Success in this event will allow the "bears" to count on the implementation of the target by 88.6% on the pattern of the "Shark". Failure will increase the risks of recovery of the uptrend.

Brent, daily chart