In January, macroeconomics took a back seat in Forex. The ball is ruled by politics and rumors of normalization. The Bank of Japan announced a decrease in purchases of assets in the QE at the next auction, as the yen began to claim the role of the G10's favorite in 2018. It was worth to note that the ECB, in the minutes of its last meeting, designated a discussion about the limit of the quantitative easing program and the possibility of withdrawing from it earlier, as the EUR/USD pair jumped to 3-year highs. However, all this happens against the background of strong data on US retail sales and core inflation for December...

Large banks like to put the weakness of the US dollar on one of the top spots in the list of factors to strengthen its competitors from the G10. In recent years, the underestimation of the Fed's likelihood of tightening monetary policy with "hawkish" comments of FOMC representatives would have built "bulls" on the "greenback" on the platform. In 2018, everything turned upside down. CME futures only implied a 73% chance of a hike in the federal funds rate in March, and Boston's head Erik Rosengren openly talks about four acts of monetary tightening this year. However, the dollar ended as it did back in 2014 with the status of an outsider, and begins in 2018 in the same position.

In this regard, the success of the pound, which has rushed to the peak since the referendum on the membership of Britain in the EU, looks like a matter of course. BofA Merrill Lynch notes that positive political news makes "bulls" for the GBP/USD pair much faster than the negative "bears." Rumors that the finance ministers of Spain and Holland are prepared to do everything possible in order to keep the UK close to the EU have become a catalyst for the sterling's rally. Later on, officials from Madrid and Amsterdam have expressed full confidence in Brexit negotiators from the European Union, the pound did not fall into a wave of selling. Smoke does not happen without fire.

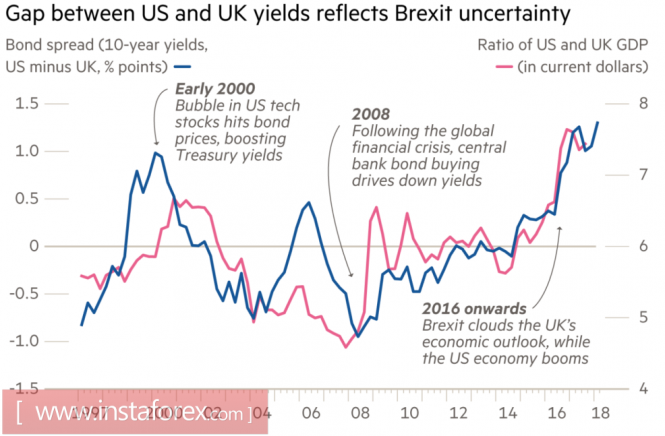

When all eyes are turned to politics, the economy rests. What is the difference that the GDP of the UK looks the weakest compared to its counterparts in the issuing countries of the G10 currencies, while the dynamics of the yield differential of US and British bonds confirm this? If the economy has reached the bottom, then why should it not be repelled from it?

Dynamics of GDP differentials and yields of US and British bonds

Source: Financial Times.

Releases of data on inflation and retail sales of the United Kingdom make the sterling one of the most interesting currencies of the week. Slowing CPI and doubts of a pick up in consumer spending, it would seem, could put an end to the Bank of England's desire to raise the repo rate. In fact, not everything is so simple. While inflation will be above 2%, the BoE will remain committed to "hawkish" rhetoric.

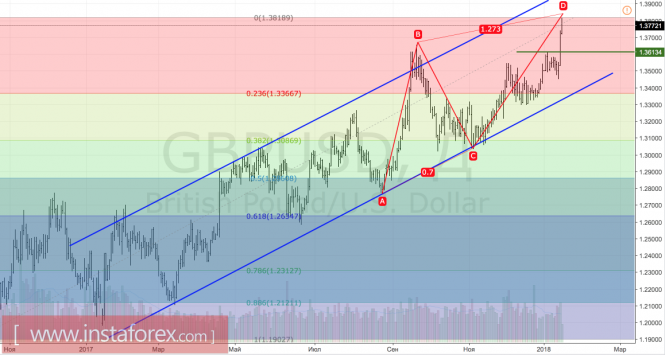

Technically, it targets 127.2% of the AB = CD pattern, which increases the risk of a rollback. Nevertheless, while the quotes are above 1.3615, the mood in the GBP/USD pair remains bullish.

GBP/USD, daily chart