AUD/CAD has been quite impulsive with bearish gains today despite worse economic reports published recently in Canada. AUD has been the dominant currency in this pair for the latest 2 months. AUD has been able to keep momentum, but market sentiment seems like changing a little bit. Recently, Canada's NHPI report was published with an unchanged value of 0.1% which was expected to increase to 0.2% and Building Permit report was also published with a significant decrease to -7.7% from the previous value of 4.4% which was expected to be at -0.7%. On the other hand, Australia's Retail Sales report showed a significant increase to 1.2% from the previous value of 0.5% which was expected to decrease to 0.4%. As for the current scenario, AUD is still quite strong fundamentally, technically, and sentimentally. So, CAD has not held bearish momentum until now as expected. In the coming days, AUD is expected to have an upper hand over CAD, leading to higher prices in the pair.

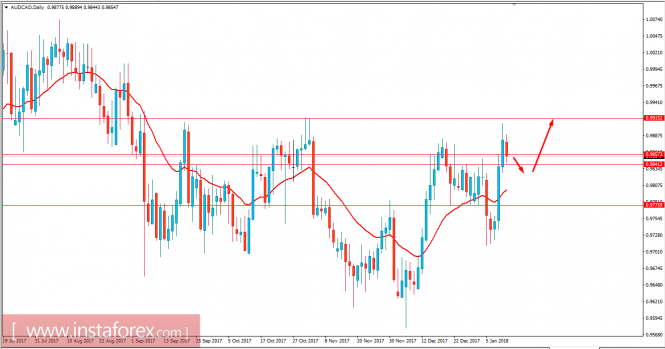

Now let us look at the technical view. The price is currently showing some bearish pressure off the support area between 0.9840-60 and expected to retrace towards the dynamic level of 20 EMA before showing some impulsive bullish momentum to proceed higher towards 0.9910 resistance area in the coming days. As the price remains above 0.9800 support area and dynamic level of 20 EMA, the bullish bias is expected to continue further.