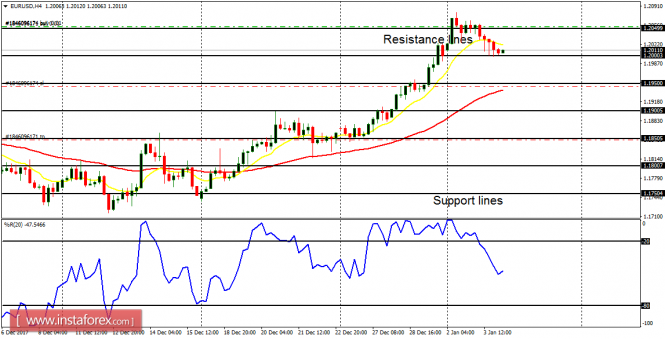

EUR/USD: This currency trading instrument corrected lower yesterday in the context of the short-term uptrend. The resistance line at 1.2050 could be tested again in an attempt to maintain the current bullishness. On the other hand, a drop of about 150 pips would result in a bearish bias in the market.

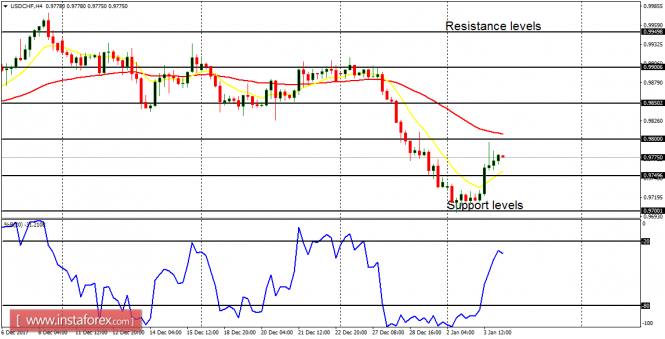

USD/CHF: This pair made a rally attempt on Wednesday in the context of the short-term downtrend. The support level at 0.9700 could be reached eventually in an attempt to maintain the current bearishness. On the other hand, a rise of about 100 pips would result in a bullish bias in the market.

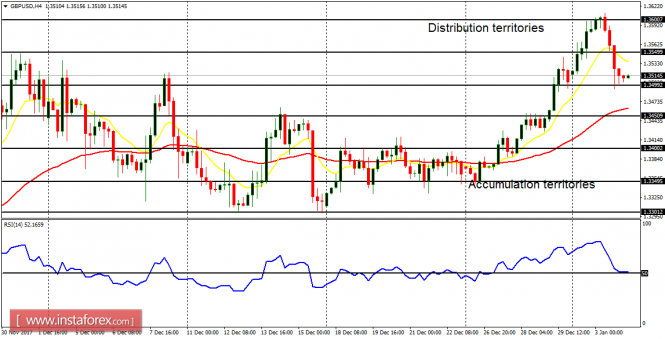

GBP/USD: After testing the distribution territory at 1.3600, the GBP/USD pair experienced a clear bearish correction. The price could go upwards from here as the correction cannot override the extant bullish bias in the market, only if the accumulation territory at 1.3400 is breached to the downside (which would require strong selling pressure).

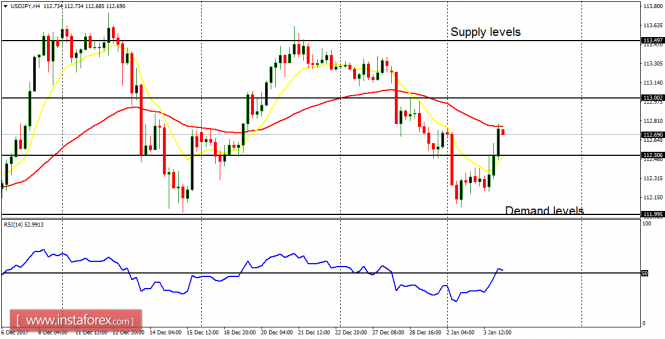

USD/JPY: The bearish bias on the USD/JPY pair has been threatened by the rally effort that was witnessed on Thursday. A movement above the supply level at 113.50 would result in a bullish signal; while a movement below the demand level at 112.00 would help to strengthen the recent bearish bias. Some fundamental figures are expected today and they may have a certain impact on the markets.

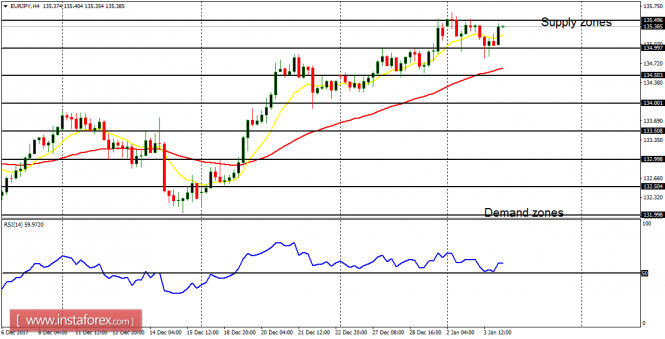

EUR/JPY: The bullish signal on the EUR/JPY pair remains intact. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. Since there is the Bullish Confirmation Pattern in the market, bulls are expected to hold out for the rest of this week before the market begins to plunge later on.