Just before the start of the European session, a slight retreat of oil is observed. The commodity prices are losing 0.5%, but still remain close to the 2.5-year highs. On the precious metals market, the leading one is palladium with 1.3% gains. Wednesday's morning on the currency market is marked by a retreat of the American currency. With regard to the US Dollar, its Australian counterpart strengthened the most (by 0.3%), placing the AUD/USD rate around 0.7750. A slightly more modest move towards the north was recorded by the euro (0.2%), which in the next few hours could push the EUR/USD pair back towards the round level of 1.1900.

On Wednesday 27th of December, the event calendar is light with important news releases. The only two worth mentioning are the CB Consumer Confidence and Pending Home Sales data from the US.

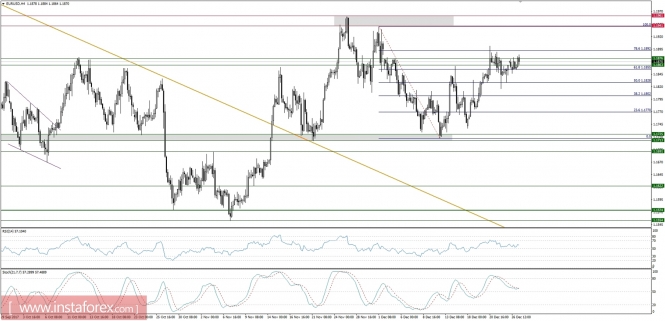

EUR/USD analysis for 27/12/2017:

The economic calendar is not very exciting just before the end of the year. In the afternoon pack of data from the US economy, the most anticipated will be indications of consumer sentiment by Conference Board (04:00 pm GMT), which, according to Bloomberg's expectations, should slightly deteriorate. In the meantime, data from the US housing market will be released. A series of recent indications from both the primary and secondary market clearly fills optimism with today's estimates of newly-signed house purchase agreements (04:00 pm GMT). We expect that the above events will not contribute to robust shifts in the currency market as liquidity keeps drying up.

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The price keeps trading sideways between the levels of 1.1828 - 1.1901 with the momentum hovering around its fifty level. Without a clear breakout above or below this level, the market will continue trading sideways. The key technical support is at the level of 1.1725 and the key technical resistance lies at the level of 1.1961.

Market Snapshot: AUD/USD extends rally

The price of AUD/USD has broken out above the 38% Fibo level at 0.7738 and keeps rallying towards the next Fibo retracement at the level of 0.7813. The momentum is strong, so the chances of hitting this level before the downtrend will continue remain solid.

Market Snapshot: US Dollar Index close to the channel support

The price of the US Dollar Index is getting closer to the channel support around the level of 93.04. After the Fed interest rate hike earlier this month, the market reversed toward the support level at 93.32 and then tried to rally, but the bull camp was too weak to make a new high above the level of 94.25. The key technical support remains at the level of 92.49.