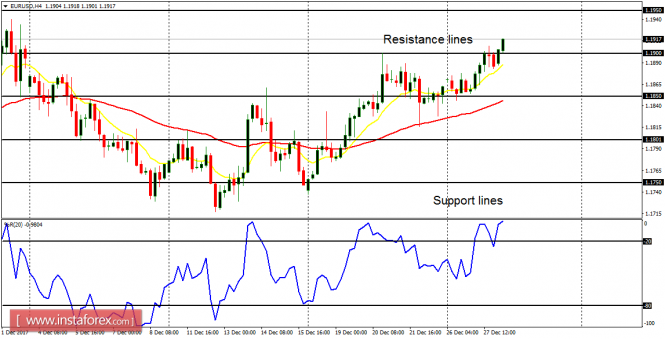

EUR/USD: The EUR/USD has been going upwards in a bullish movement continuation. Price has moved above the support line at 1.1900 and it may soon reach the resistance line at 1.1950. However, a strong buying pressure is needed for the price to break the resistance line at 1.1950 to the upside, and then propel it towards another resistance line at 1.2000. That is a possibility that could be attained next week.

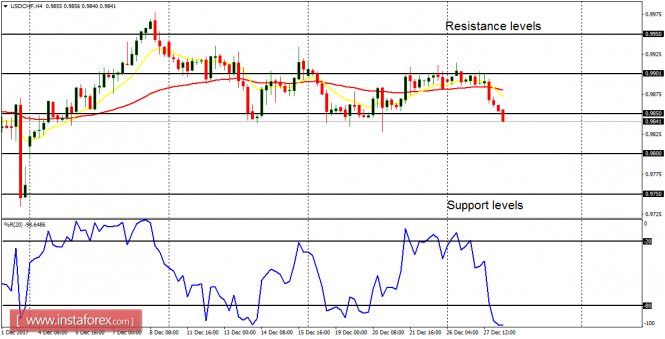

USD/CHF: This pair has broken southwards from its recent short-term consolidation. This has put more emphasis on the ongoing bearish outlook on the market, and the support level at 0.9800 could be reached this week, and possibly exceeded next week. The price has already gone below the resistance level at 0.9850.

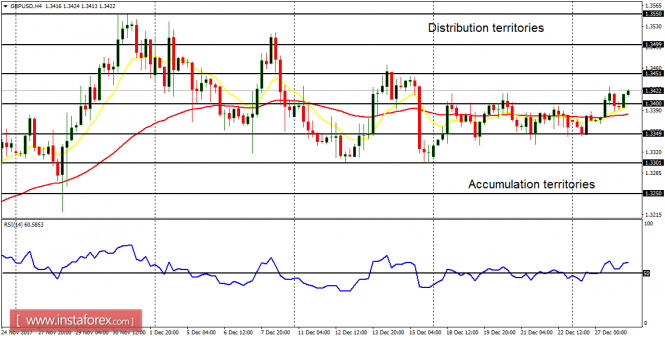

GBP/USD: This pair has not made any changes to the neutral bias on it. The price is thus expected to oscillate between the accumulation territory at 1.3250 and the distribution territory at 1.3500 within the next several trading days. However, a breakout will occur early January. A few fundamental figures are coming out today and they may have an impact on the market.

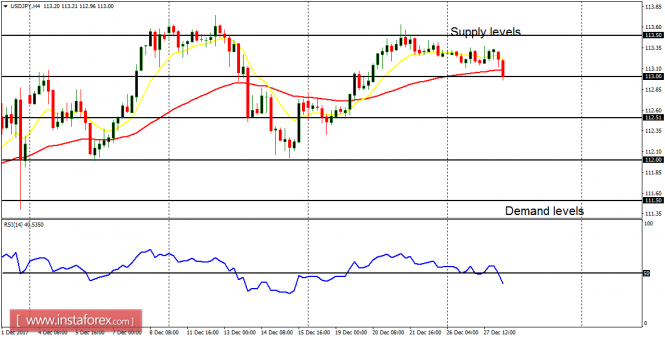

USD/JPY: This currency trading instrument is moving lower and lower, but that is not yet strong enough to threaten the bullish outlook on the market. Once the demand level at 117.50 is breached to the downside, the bias on the market would turn bearish (and that could be the situation till the end of the year).

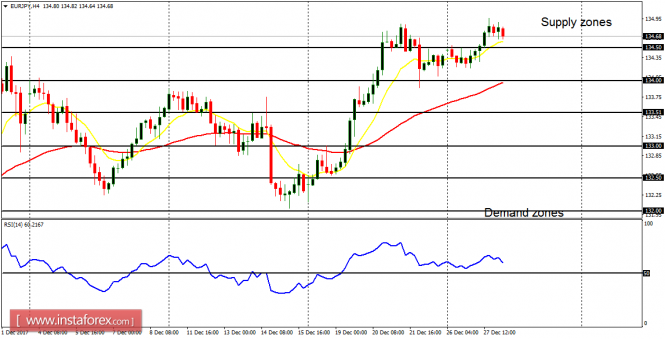

EUR/JPY: This cross is bullish – and unlike the USD/JPY – it has been able to maintain its bullishness. The EMA 11 remains above the EMA 56, and the RSI period 14 remains above the level 50. This a Bullish Confirmation Pattern. Price is above the demand zone at 134.50 and would target the supply zone at 135.00.