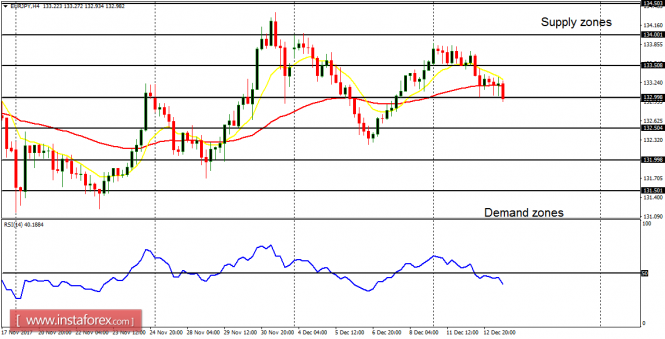

EUR/USD: The bearish signal on this pair is still valid. Price has made some bearish effort this week, now below the resistance line at 1.1750 and going towards the support lines at 1.1700. That is the target for this week, which should be reached ultimately.

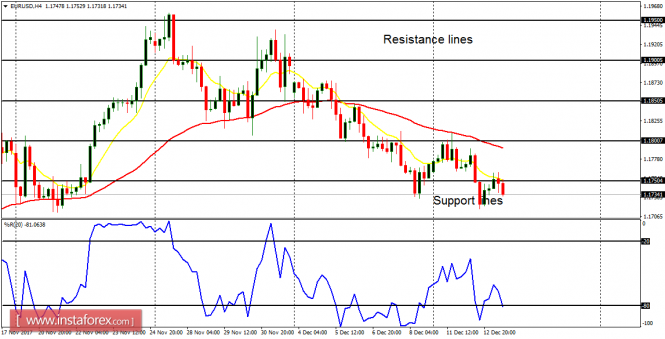

USD/CHF: The USD/CHF pair is consolidating in the context of an uptrend. While the resistance levels at 0.9950 and 1.0000 could be tested, the pair is expected to end up plummeting this week, because CHF would showcase an extraordinary level of stamina. Other currencies would also drop versus CHF.

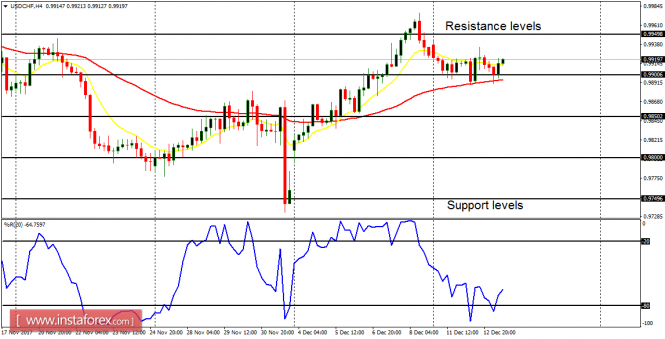

GBP/USD: There is a "sell" signal on the Cable. The EMA 11 has gone below the EMA 56 and the RSI period 14 has gone below the level 50. Price would is likely to continue going downwards, reaching the accumulation territories at 1.3300 and 1.3250.

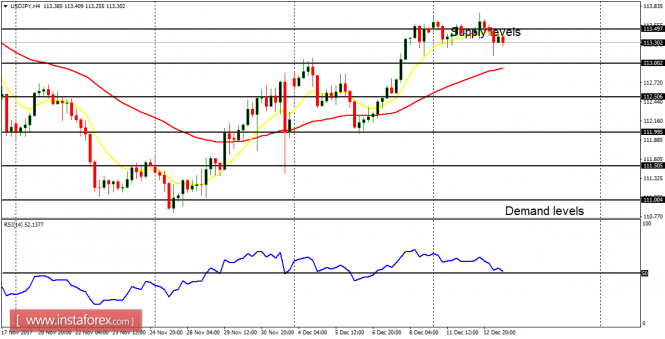

USD/JPY: This currency trading instrument is moving sideways in the context of an uptrend. There is a bullish bias on the market, and the supply levels at 113.50 are expected to be reached – even if there is going to be any major pullback at last. A rise in momentum is just around the corner.

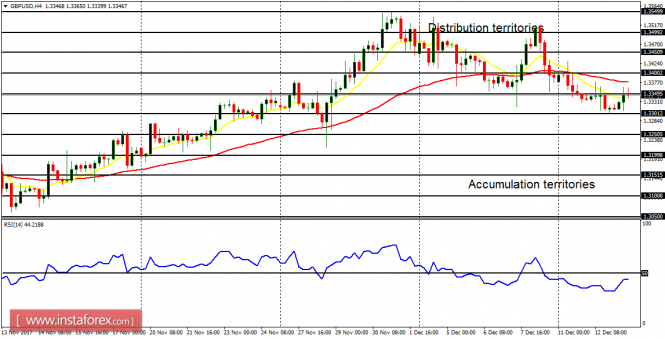

EUR/JPY: This cross has gone gradually southwards (so far this week). The RSI period 14 is below the level 50, and the EMA 11 is about to cross the EMA 56 to the downside. Once the demand zone at 1320.00 is breached to the downside (which would require a great volatility), a Bearish Confirmation Pattern would form in the market.