Eurozone

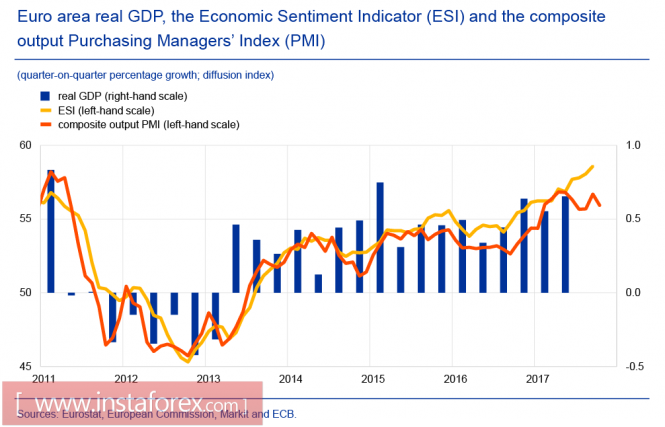

Last week, the ECB and the European Commission presented two versions of the development of the economic situation in the eurozone. The European Commission increased the forecast for 2017 from 1.7% to 2.2%, noting that the improvement in the dynamics in the euro area is associated with a significant improvement in economic sentiment, moderate financial conditions and sustainable consumption.

The ECB came to a similar conclusion that private consumption continues to be the key factor of the continuing economic growth, which shows growth against the background of a fall in fuel prices and improvements in the labor market. PMI holds at the level of seven-year highs, and the Economic Sentiment Index has already significantly exceeded the pre-crisis level.

While a number of key indicators for eurozone's economy does not look worse, it is doing better than the US economy. The proxy for surplus trade balance contributes to the capital outflow from the eurozone, but the direction of its movement is somewhat different from expectations - investors invest significantly more in Asia than in the US. The growth of the dollar in recent months contributed to the expectations of growth in the spread between the yield of US securities and eurozone countries, but this driver is weakening, as the US economic growth and the inflation situation lag behind the Fed's plans for normalizing monetary policy.

On Tuesday, an estimate of GDP growth in the third quarter in Germany and the eurozone as a whole will be published. Analysts suggest that for both indicators the result will be no worse than in the second quarter, and the euro can receive significant support.

The EURUSD pair will try to test the boundaries of the channel, which is approximately at the level of 1.1750 In case it succeeds, an attempt by the bulls to regain the momentum is possible. At the same time, long-term expectations are changing in favor of the dollar, and the likely growth will most likely be used for selling in the second half of the week with a prospect of withdrawing to the recent lows of 1.1550.

United Kingdom

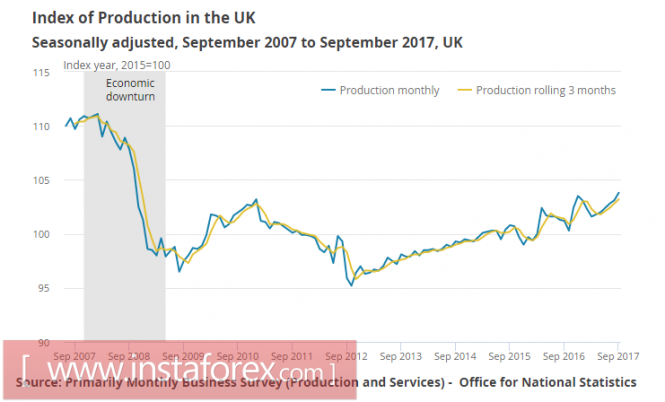

The pound won against the dollar during trading on Friday after the publication of data on industrial production and trade balance in September, which significantly exceeded the forecasts. The production grew by 0.7% against the growth of 0.3% a month earlier, the growth in processing accounted for the same 0.7% against 0.4%, year-on-year growth of 2.5% and 2.7% respectively.

The trade balance significantly reduced the deficit in September to 11.25 billion pounds against 12.8 billion pounds a month earlier. Analysts did not expect the deficit to decline, on the contrary they expected it to rise.

The published data confirm the accuracy of the course chosen by the Bank of England to tighten monetary policy, but let's not forget that industry is only 14% of the country's economy, and therefore the effect of published data will be short-lived.

On Tuesday, data on prices will be published in October, further growth of inflation is expected. If the data released is not worse than projected, it will support the pound, as well as it will increase the chances for another rate hike.

At the same time, the key issue for investors, namely the UK's exit from the EU, is still unresolved. Brexit will be triggered on March 2019 and so 17 months remain, and negotiations are at the same stage as at the very beginning. There is no progress, and further inaction of politicians will lead to a deterioration in the investment climate and will put pressure on the pound.

Until Tuesday, the pound will most likely trade neutral, to break through the 1.30/ 1.33 trading range, conditions have not yet been formed.

Oil

Brent finished the week above $63/bbl. A factor capable of causing correction in the oil market has not yet been found.

The material has been provided by InstaForex Company - www.instaforex.com