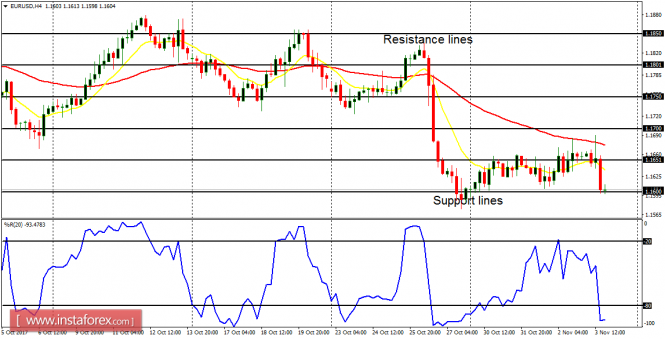

EUR/USD: This pair moved sideways from Monday to Thursday and then went further downwards on Friday, while the dominant bias remains bearish. This week, the support lines at 1.1600 (which has almost been tested), 1.1550 and 1.1500 may be tested owing to a strong bearish bias on EUR pairs for the week.

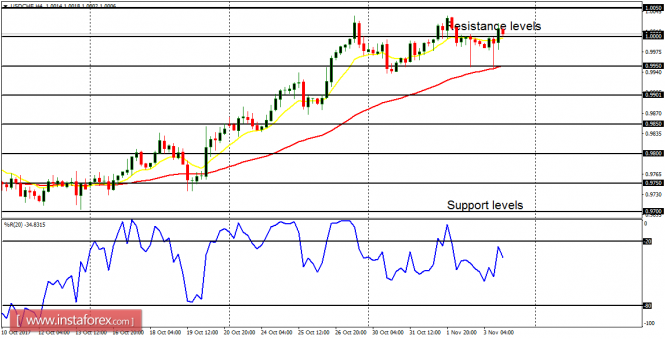

USD/CHF: This currency pair did not move seriously last week, but it was able to maintain its bullishness. Price managed to close above the psychological area at 1.0000 on Friday, poised to move higher from there. The targets for this week are located at the resistance levels of 1.0050, 1.0100 and 1.0150. The resistance level at 1.0150 would require a very strong buying pressure to be breached to the upside.

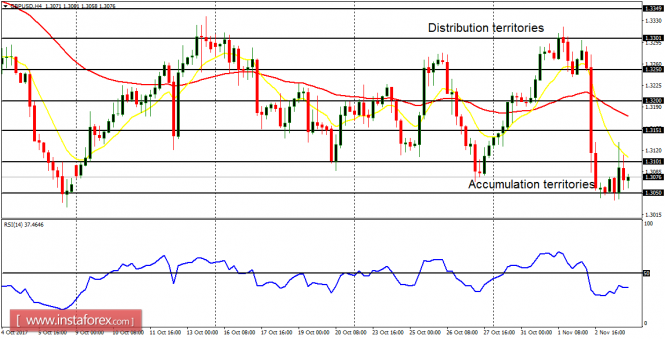

GBP/USD: This currency trading instrument went upwards from Monday to Wednesday last week, testing the distribution territory at 1.3300. More bullish journey was rejected at that distribution territory as price plummeted from there, losing 250 pips and testing the accumulation territory at 1.3050. The outlook on GBP pairs is bearish for this week, so more southwards movement is expected. The weak EUR/USD would also help to drag the GBP/USD further downwards.

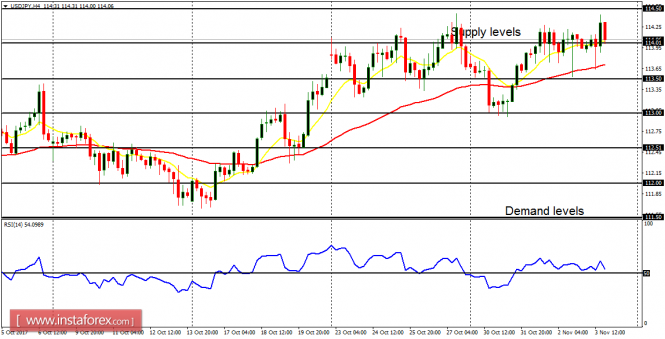

USD/JPY: This market went downwards on October 30, reversed on October 31, and consolidated for the rest of the week. This week, it is more likely for the price to go higher and then to go lower. First, because the outlook on USD pairs is bullish for this week, and also because of an existing Bullish Confirmation Pattern in the market. The supply levels at 114.50 and 115.00 would at least be reached.

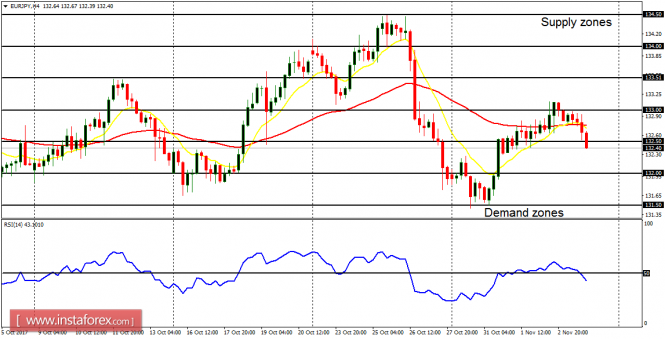

EUR/JPY: Last week the EUR/JPY pair rallied in the context of a downtrend, moving from the demand zone at 131.50 to test the supply zone at 133.00 and then coming downwards on Friday. The price closed at 132.40 (below the supply zone at 132.50). Owing to a bearish outlook on EUR pairs this week, the market is supposed to go further southwards.