The dollar slowly but surely returns with the initiative of preparing for a protracted growth, and there are several reasons for increasing demand for it.

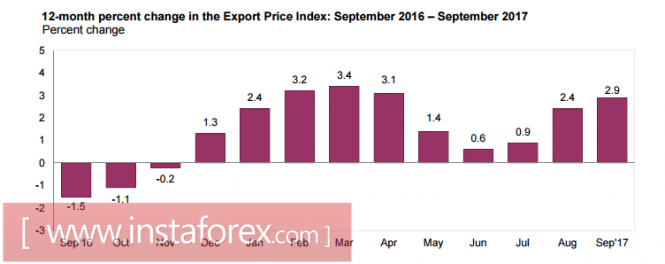

The volume of industrial production in September increased by 0.3% compared to August, which is the first increase since June. It shows that the industry has overcome the consequences of hurricanes. The report of the Ministry of Labor on foreign trade prices also shows a positive trend whereas import prices rose from 2.1% to 2.7% and export grew by 2.9% compared to 2.3% a month earlier. This is a good sign that an additional price growth factor will appear in the consumer sector.

Following the comments of representatives of the Fed, the regulator pays more attention to the labor market than to inflation, considering its decline as a temporary phenomenon. This position has been repeatedly voiced earlier and is intended primarily to give guidance to investors since only a growing labor market is able to maintain a high level of consumer activity. Inflation will also grow automatically due to revenue growth. Looking at the situation, the dynamics of prices for imports and exports support the growth of inflation and the recovery of industrial production also plays in favor of the dollar. Moreover, the market has currently no concerns that the rate will be raised for the third time this year at the FOMC meeting in December. According to CME, there is a probability for the futures market to be a step more than 90%.

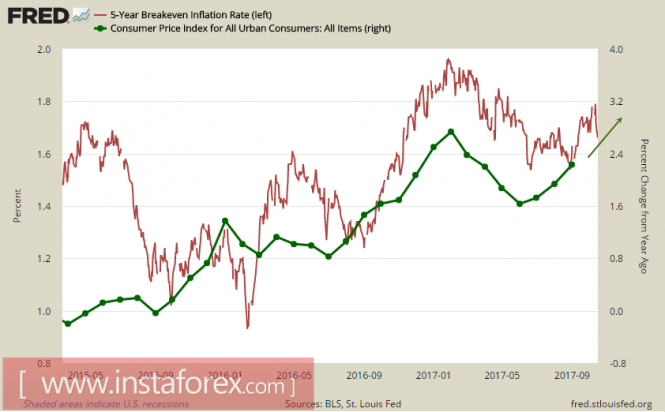

Expectations for inflation are beginning to change in favor of its growth. The yield on 5-year bonds and its Treasury Inflation-Protected Securities (TIPS) began to increase once again and pushing away from the June low. This indicator is valuable as it reflects the expectations of business and not just of consumers. Therefore, outrunning growth in yields, as a rule, has also indicated an increase in inflation in the near future.

Why does the dollar have no way out on the growth trajectory?

One reason is connected with uncertainty about the future policy of the Fed. The mandate of Janet Yellen expires in February. To date, the shortlist of Donald Trump contains five names from which he intends to choose the future head of the Fed before the tour scheduled for early November in Asia. The top choices are Powell and Taylor, and they both hold more hawkish views than Janet Yellen. If Trump chooses one of these two candidates, the likelihood of a continuation of the normalization policy will not decrease, but will even increase further. This could increase market expectations at the rate for 2018 by another quarter point. Trump's announcement of the candidate for the post as the Federal Reserve's head, which still has to be approved by the Congress, may serve as an excuse for aggressive buying of the dollar.

There are also concerns about the worsening of financial conditions due to the appreciation of the dollar. The whole framework will be under threat if the growth of the US economy is insufficient to compensate for the tightening of credit policy in connection with the growth of rates. The rate hike should not lead to a slowdown of the business activity while the worsening financial conditions should be compensated by the tax reform. In the end, this can be accomplished by easing fiscal pressure on the business. Based on this idea, reducing the tax burden will help accelerate the growth rate of wages, which in the end will give a powerful stimulus to increased consumption. Congress has not yet received the final draft of reforms, but expectations establish a powerful pent-up demand for the dollar.

The U.S. financial authorities should prevent the contraction of the lending market in the U.S. currency which requires a strong dollar policy. Most likely, the scenario will include raising the yield of securities which automatically results from higher rates, and the compensation for the deterioration in the trade balance will go along the tightening line customs regulation.

The dollar is in the position of a runner and frozen at the start as it waits for the shot of the starting pistol. The absence of important macroeconomic reports this week could push the growth in demand for the dollar at the beginning of next week. Yet, the mood has already reversed investors. The dollar will gain more advantage although, the primary concerns are the euro, franc, and yen.

The material has been provided by InstaForex Company - www.instaforex.com