The dollar is not in the best condition as it approaches the key autumn meeting of the Fed. Despite the fact that one of the burning issues has been resolved positively, namely the issue of the level of public debt which automatically removes the probability of a government default, a number of indirect factors still indicate serious problems in the US economy.

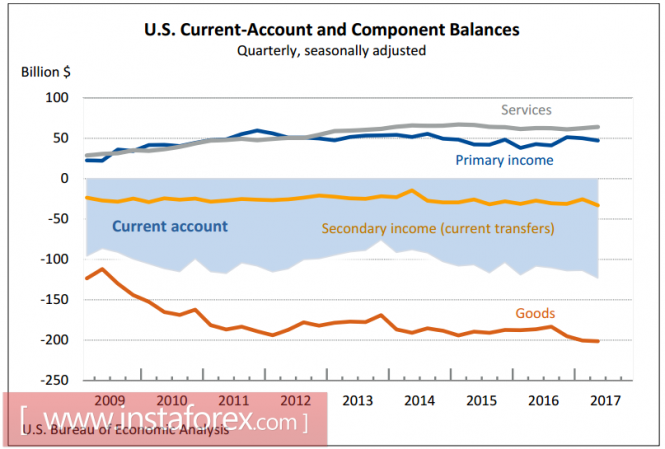

The current account deficit reached 123 billion dollars in the 2nd quarter. This is the maximum value since 2008. The growth of the deficit relative to the 1st quarter was 8.5%. In all key components namely investment income, net transfers, the difference between imports and exports, the results were worse than forecasted.

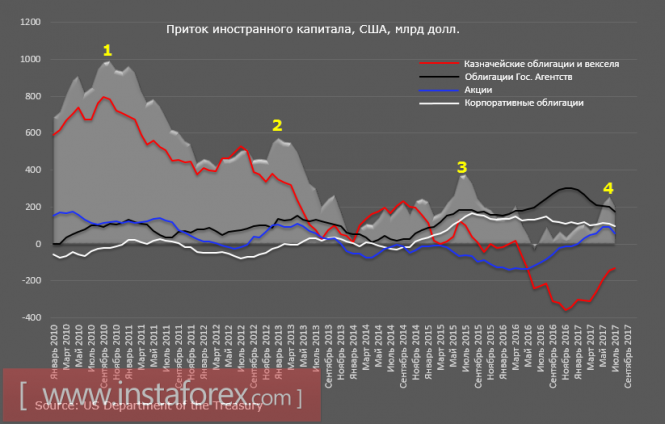

The US Treasury published another report on the inflow of foreign capital. The inflow for the last 12 months inclusive of July remained positive. However, a sharp decline to a 3-month low was recorded. It is obvious that "Trumpanomics" no longer inspires investors. The restoration of investments in the stock market, which was marked since February, has slowed down sharply. Investments in Treasury Bonds & Notes have remained on negative territory. Moreover, the aggregate inflow tends to slow down, which is clearly seen in the graph below. Each subsequent peak of activity, if you count from the peak reached in October 2010 at the "post-crisis" period, is lower than the previous one.

The simultaneous decrease in the rate of growth in the collection of taxes, which are noticeably lagging behind GDP growth, clearly indicate that the entire growth of the US economy at the present stage is formed due to the outstripping growth of the debt. Debt at all levels (from federal to municipal) grows faster than the economy. And household debts (consumer, mortgage, education, etc.) grow faster than income.

The branching point for the US regulator is approaching. The market must understand if there is still a plan for reforming the economy that will reverse the negative trend, or if there is a plan with no chance of being realized, or if there is no plan at all.

There are three possible scenarios for the market reaction from the extent to which the results of the meeting will meet market expectations.

The main scenario, from which the players proceed at the moment, looks positive. Throughout the spectrum of G10 countries, there is an increase in stock indices and bond yields, which indicates the departure of capital from the debt market. Prices for gold fell to a monthly low. Oil, on the contrary, almost closely approached the maximum of the year. The market expects that macroeconomic forecasts will at least not be worsened, and Fed Chairman Yellen will finally announce the beginning of the reduction of the balance sheet. The text of the final statement is expected to be more hawkish, which will increase the chances that in December, the Fed will once again raise the rate and will not break out of its own schedule.

The dollar, in case of realization of market expectations, will show the tendency to grow, especially against defensive assets such as yen, franc, and even euro.

If the outlook turns out to be more positive, and Yellen's speech is more militant, then the market can formalize a global turn in the dollar, completing the phase of weakness, which lasted from January.

And only if the expectations of the market are not justified, only in this case will the dollar react with a decrease.

The balance is rather unstable. We have already mentioned that the financial conditions for business do not look too attractive. A rate hike can cause the opposite effect. The dollar, after the period of high volatility, will not find the strength to grow.

Thus, we must proceed from the fact that the Fed meeting is a key event, but not the only one. Markets will wait for the tax reform, which will put everything in its place.

The material has been provided by InstaForex Company - www.instaforex.com