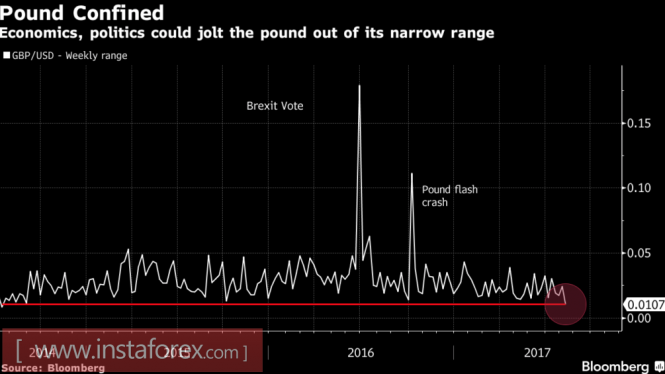

A busy economic calendar makes the British pound the main candidate for the role of the most interesting currency of the week. Releases of data on inflation, the labor market and retail sales will clarify the prospects for raising the repo rate and will diagnose the economy of Foggy Albion. At the same time, the risks of increased volatility are increasing, which, perhaps, will help the sterling break the sad tradition. Recently, the latitude of the weekly trading range paired with the US dollar tends to the minimum since 2014.

Weekly dynamics of GBP / USD

Source: Bloomberg.

Despite the fact that Bloomberg experts are optimistic about inflation (forecast + 2.7% y / y), wages (+ 2% y / y) and retail sales (+0.2 m / m), Nomura believes that they will not change the whole negative picture for the British pound. ING does argue that important statistics will be the last nail in his coffin, as it will finally scare the Bank of England. The GBP / USD rally in June-July was made possible due to the growth of expectations for an increase in the REPO rate, but after the last meeting of MPC in August, the chances of a monetary restriction in 2017 fell from 50% to 24%, and further deterioration of the health of the economy of the Foggy Albion would minimize them.

Morgan Stanley predicts the achievement of parity in the pair EUR / GBP in early 2018. Among the weak points of sterling, the bank calls the fall in real rates of the UK debt market, political risks and the weakness of the economy. Recent success in retail sales is associated with an increase in unsecured lending, while an increase in the share of household spending on debt repayment and a decline in real wages can lead to a recession.

According to BNP Paribas, one can hardly expect a positive reaction of the pound to the news of a political nature. Negotiations on Brexit are sluggish, Chancellor Philip Hammond and Commerce Minister Liam Fox talk about the length of the transition period. Subjects of the United Kingdom will have to endure uncertainty long enough, however, judging by the investment flows, non-residents are not ready to do this. They withdraw money from the country, political risks in which leave much to be desired, creating problems with financing the current account deficit. At the same time, devaluation does not solve the problem of exporters. Imported raw materials are becoming more expensive, which limits the growth of competitiveness.

Under the circumstances, a weak dollar is almost the only factor that limits the potential for corrective movement in GBP / USD. The release of data on the July inflation in the US lowered the probability of an increase in the rate for federal funds in December to 36%, although a week ago it was about 47%. Nevertheless, the data came out not the worst, so that the "American" is soon able to go into a counter-attack.

Technically, the GBP / USD pair entered the consolidation in the range of 1.2945-1.303. The breakthrough of its upper limit will strengthen the risks of recovery of the uptrend, a successful assault on support at 1.2940-1.295 will create prerequisites for the development of correction.

GBP / USD, daily chart