If the minutes of the July meeting of the ECB scared the bulls for the euro, then it was only for a little while. The European Central Bank expressed its concern about the future strengthening of the exchange rate, saying that the current EUR/USD movement is in line with the recovery process of the euro-zone economy. Actually, the GDP growth of the Euro monetary bloc, although not much, still outstripped the growth of its American counterpart, and the low level of political risks after the defeat of Eurosceptics in France contributes to the capital inflow. In contrast to the Old World, things in the New World are going, to put it mildly, not very well.

Positive data on the labor market and retail sales did not add optimism to the supporters of the US dollar. Judging by the minutes of the last meeting of the FOMC, the Fed's fears about inflation are still high. At the same time, the "dovish" rhetoric of the head of the Federal Reserve Bank of Dallas Robert Kaplan, urging the U.S. central bank to be patient in the conditions of slowing CPI and PCE, lowered the chances of a December monetary tightening from 48% to 42%.

Pressures on the USD index was created due to the political strife within the United States. Dissatisfied with the position of Donald Trump on a number of issues, business leaders began to leave the president's economic councils, which resulted in their liquidation. Discontent with the actions of the head of the White House was expressed not only by politicians, including representatives of their own Republican Party, but also by economists, which undermines confidence and contributes to the further collapse of the dollar. Correlation of these indicators convinces that the market has recently reacted more to rumors and gossip of a political nature than to macroeconomic statistics.

The dynamics of the dollar index and the mistrust index of Donald Trump

Source: Bloomberg.

By August 26, the focus of investors' attention will be on the meeting of heads of central banks in Jackson Hole. Following the June speech of Mario Draghi about the victory over deflation, the markets praised the ECB excessively. The media called him a more influential figure than Janet Yellen, the man who provoked the minimum peak of hysterics. In this respect, the traditional summit at the end of August was compared with past events, when ex-Fed Chairman Ben Bernanke announced the end of the QE, and at the same Draghi announced the launch of the quantitative easing program. The record of the last meeting of the ECB has shown that there are no surprises waiting for the "bulls" for the euro.

The Governing Council examined the problem of communicating information. Supporters of the gradual preparation of investors for the normalization of monetary policy, led by Benoit Coeure, were forced to retreat. Considering this as the slightest signal about the winding up of the QE, raised EUR/USD quotes. Over the past three months, the trade-weighted euro rate has soared by 5%, which creates serious problems for inflation, export and financial conditions and allows the projection a slowdown in the euro area's GDP.

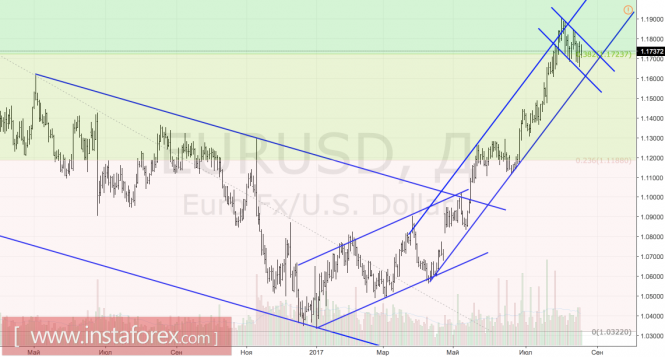

Technically, the exit of quotes beyond the descending short-term channel and a successful resistance push ahead of 1.181-1.182 will be the evidence of the completion of the retreat and will open the way for the EUR/USD upwards. On the contrary, the update of the corrective low near 1.167 will increase the risks of development of the bearish counterattack in the direction of 1.15.

EUR / USD, daily chart