In anticipation of the statistics on the US labor market, the main currency pair settled near the 31-month highs. The market reacted poorly to statistics on private sector employment from ADP, knowing that the main secret should not be looked for. Given the fact that the Fed is concerned about inflation, all investors' attention will be riveted to figures on average wages. However, on the sidelines of the Forex rumor, it is rumored that only a very strong positive surprise can save the dollar.

While the basic index of spending on personal consumption is near 1.5%, which is far enough from the target, the Federal Reserve can afford to pull the tires. The futures market only gives a 44% chance of raising the federal funds rate in December, so plans for the three acts of monetary restriction may not come to fruition. All of this plays into the hands of "bulls" on the US stock indices and "bears" in the dollar. Donald Trump, who said at the beginning of the year that a strong currency creates problems, may require an ovation, especially since it is not possible to open champagne on other occasions. Bills on changes in the health system do not pass. The implementation of the tax reform is in limbo, and it's the seventh month in power.

Politics exerts far more pressure on the dollar than other factors. It is unlikely that the "bears" at the USD index like a strong labor market or acceleration of GDP to 2.6% q / q in the second quarter.

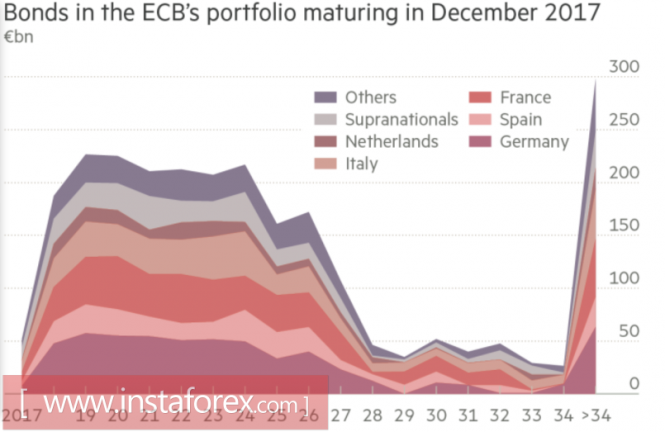

As for the euro, the recent successes of this currency look excessive. Against the backdrop of sluggish inflation in the euro area (1.3%) and slowing business activity in July, the ECB is unlikely to begin to wind down QE earlier than the market expects. In addition, in 2018, the maturity of the bonds will reach € 120 billion, and in 2019 this amount will grow to more than € 200 billion. These resources need to be reinvested, that is, reducing the scale of asset purchases from € 60 to € 50 billion next year will mean that the European Central Bank has not lost a bit of its cheap money policy. But this factor was taken into account by the "bulls" for EUR / SUD.

The maturity of assets on the balance of the ECB

Source: Financial Times.

It is clear that everyone wants to have time to jump into the last car of the northbound train, but large players can use the negative from the US labor market to fix profit on long positions. You can, of course, argue, saying that the Fed is still using the practice of reinvesting income. Nevertheless, the States tied with QE in 2014, and in 2015-2017 increased rates several times.

Technically, the outlook for the "bears" in EUR / USD looks hopeless. However, it should be noted that the pair's growth in recent days has been on declining volumes, which is a sign of weakness. In general, as long as quotes are above the support of 1.1725 (38.2% of the last descending long-wave), bulls retain total control over the euro. The nearest important resistance is located at around 1.215.

EUR / USD, daily chart