The increase in iron ore prices to a four-month high and some slowdown in business activity in China allowed AUD / USD to enter the consolidation in the range of 0.788-0.8015. After a swift rally, as a result of which the trade-weighted rate of the "Aussie" jumped by 7% since the beginning of June, the "bulls" obviously need a breather. It is curious that everything began with the moderately optimistic rhetoric of the RBA at the previous meeting, continued after the Reserve Bank discussed the issue of a neutral rate in the protocol, and now the process can easily go back if the regulator becomes concerned about the revaluation of the national currency.

Judging by the last matches of the head of RBA Philip Lowe and his deputy Guy Debell, the management is worried about the excessive fastening of the Australian dollar. They emphasized the own way of the Reserve Bank, which will not rush into the pool of monetary restriction, following the rest. As for the neutral rate, the discussion of this issue is not a reason to expect its increase in the near future. This is the factor, according to Goldman Sachs, is the basis for sales of AUD / USD at the top. Investors are too carried away with the idea of tightening monetary policy, and soon a shadow of disappointment will fall on their shoulders. Curiously, the median estimate of the equilibrium cash rate by Bloomberg experts is 3%, RBA says about 3.5%. 2.5% - inflation, 1% - the real rate. In the second quarter, consumer prices disappointed (the rate slowed to 1.9% y / y), so it's not yet possible to wait for monetary restriction earlier this May.

And yet, the "Australian" has something to answer. The main driver of its growth is a favorable external background. The fact that the Fed is shifting the timing of the normalization of monetary policy, contributes to the growth of US stock indices, a global risk appetite and a decrease in the volatility of financial markets. In such conditions, the demand for profitable bonds is steadily rising. At the same time, Australian and New Zealand dollars are the riskiest G10 currencies.

Dynamics of AUD / USD and chances for monetary restriction of the Federal Reserve System

Source: Bloomberg.

If we add to the above factors of restoring the positions of commodity market assets and the weakness of the US dollar, it becomes clear why the "Aussie" climbed so high. Along with iron ore, oil, gold and other assets of the raw materials market are growing, which has a positive effect on the foreign trade of the Green Continent and allows the RBA to cover up the chapter on the process of strengthening the national currency. The direction of the short-term AUD / USD campaign depends on which side the Central Bank will choose at its meeting on August 1.

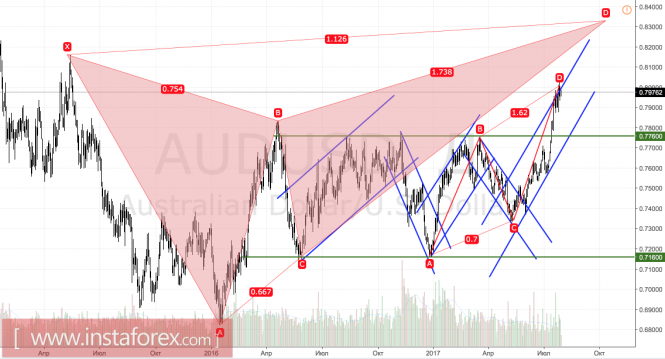

Technically, the "bulls" of the pair analyzed leave no hope for the implementation of the target at 127.2% for the reversed pattern of the "Perfect Butterfly". Nevertheless, the fact that the target of 161.8% for AB = CD and the upper limit of the upward trading channel have been reached, reinforces the correction risks in the direction of 0.783 and 0.776.

AUD / USD, daily chart