Eurozone

The ECB kept the monetary policy unchanged at the July 20 meeting. The ECB head, Mario Draghi's speech was underlined by dovish sentiments at the press conference. However, it had no effect on the market's reaction.

The emphasis was on inflation. Draghi said that despite the growth of the economy and reduction of unemployment, these parameters are not decisive factors in policy making. This is because the ECB should first consider price stability. With inflation remaining weak along with wage growth caused by the impending fall in energy prices in the coming months, there is no need to wait for inflation to grow. In other words, there are no economic prerequisites in the reduction of the incentive program.

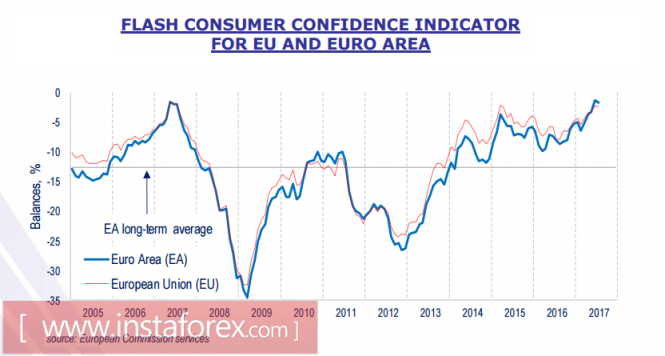

Draghi did everything he could but the market did not believe him. The signals of economic growth which are too strong will force the ECB to react, according to market players. The euro continues to be in demand despite Draghi's desperate attempts to stop growth. According to the European Commission, the Economic Sentiment Index (ESI) for June increased significantly in the euro area by 1.9 points (to 111.1) and in the EU by 1.6 points (to 111.3), reaching the highest level since August 2007.

The focus of expectations shifted to September 7 but Draghi refused to answer the question about whether the next meeting will be open for discussions regarding the reduction of the incentive program. He said that the ECB members unanimously left this date open.

Today, Markit will publish preliminary values for the business activity indices in the euro area for the month of July. It is expected that they will remain at the level of five-year highs, which will support the euro. In general, this week for the euro will be calm since no significant macroeconomic events are planned. Instead, the market will be more focused on news from the United States.

The euro remains the favorite in the currency pair. Signs of change in the ratio of investors to the dollar have not yet been observed. The political crisis in the US is gaining momentum and it is quite likely that the impeachment process of President Trump will begin. The achievement of 1.18 for this week is already likely.

United Kingdom

The pound received support after the publication of data on retail sales in June. The growth was 0.6% at an annual rate of 2.9%. Both are above the level of May and higher than expected. This should compensate, to some extent, the negative effects of the slowdown in inflation. However, the market did not react positively to the sales growth which hid stagnation in the dynamics of retail prices. This has not changed since February 2017 and therefore, confirms the policy of slowing inflation.

The key data for the pound will come on Wednesday. A preliminary estimate of GDP growth in the second quarter will be published with negative expectations. There is a serious danger of seeing a weak report which, combined with low inflation, will increase the likelihood of the Bank of England refusing aggressive rhetoric, provoking a decline in the pound.

At the same time, one cannot ignore the fact that the markets are highly disappointed because of the delay in launching Trump's incentive program. The dollar remains under strong pressure. This factor can prevent the development of a downward dynamics in the pound.

Oil and ruble

Today, the meeting of the OPEC Technical Committee begins. According to preliminary information, quotas for oil production in Nigeria and Libya will be discussed. Both countries publicly stated the need to increase production in order to achieve a stable level of production. After this, they will be ready to join the OPEC agreement.

Quotes of oil turned up last week with some of the incoming information being clearly bearish. In particular, according to the report of Petro-Logistics, the volume of OPEC deliveries will exceed 33 million barrels in June. Production per day will increase relative to the values in June.

The Bank of Russia will hold a regular meeting regarding its monetary policy on Friday, July 28. Market expectations are neutral because of the threat of inflation. The rate may remain unchanged or a decline of 0.25% may occur. If this happens, the text accompanying the statement will be cautious without indications of a further decline. The ruble currently doesn't have a driver so trading in the range of 58/60 for the RUB/USD is most likely.

The material has been provided by InstaForex Company - www.instaforex.com