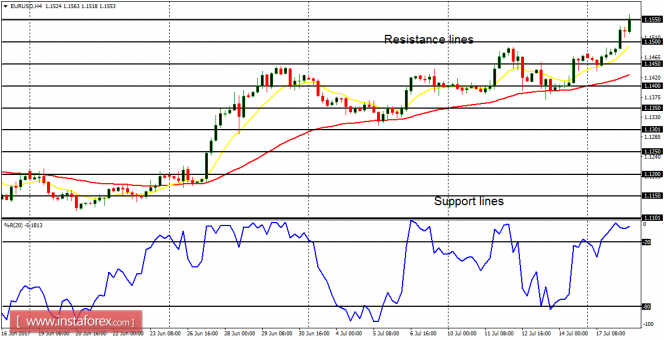

EUR/USD: The EUR/USD has moved upwards seriously this week, exceeding our first two targets (1.1500 and 1.1550). The price is now going towards the resistance line at 1.1600, and it may test it between today and tomorrow. The outlook on the EUR/USD is bullish for this week.

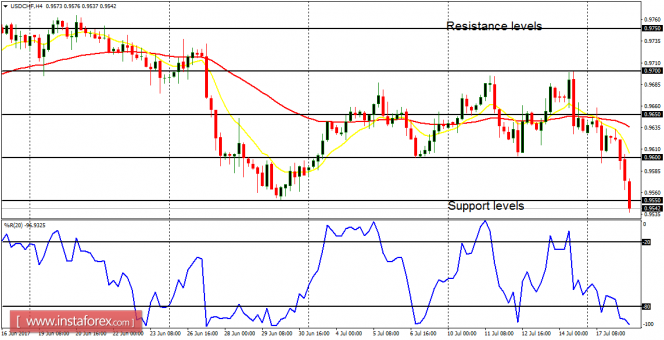

USD/CHF: This market has gone seriously southwards this week, ending the short-term neutrality on it. Our first target at 0.9550 has been exceeded, and the next target would be the support level at 0.9500, which is expected to be exceeded as well. There is a Bearish Confirmation Pattern in the market.

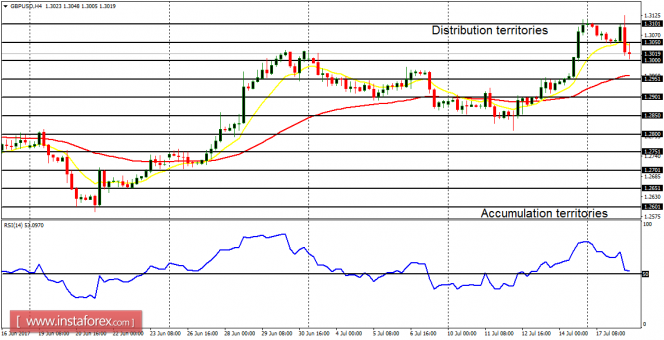

GBP/USD: The GBP/USD has been volatile so far this week, but the bullish bias on it has remained intact (unless the price drops by 200 pips from here). The outlook on GBP pairs is bullish for this week, and as such, it is possible to see the GBP/USD go upwards by over 200 pips from here, putting more emphasis on the recent bullish bias.

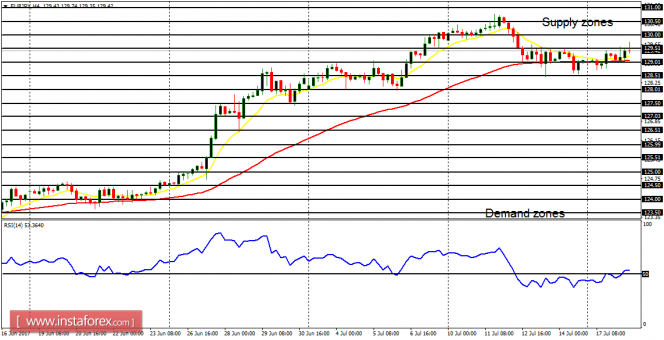

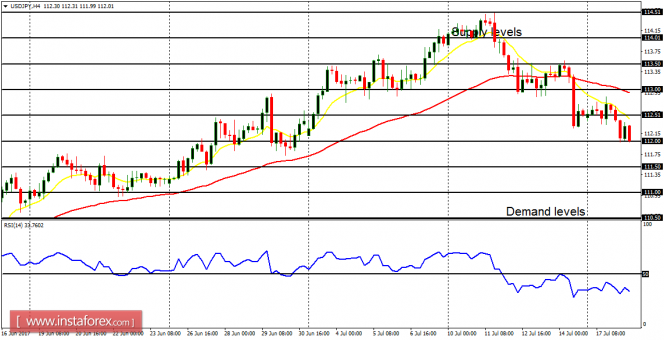

USD/JPY: A Bearish Confirmation Pattern has appeared on this currency trading instrument, as it goes south more than 70 pips this week (till present). There is a bearish signal in the market, and the price has gone below the supply level at 112.00, now nosing towards the demand level at 111.50, which is the next target right now.

EUR/JPY: This cross has not done much so far – in fact, it is consolidating right now. The stamina in EUR has helped in keeping the bullishness in the market. The situation may change. The demand zone at 128.50 has tried to halt further correction, but the price may break below it as it goes further southwards, thus invalidating the uptrend. It should be borne in mind that the outlook on JPY pairs is bearish for July.