Gold futures dropped amid the field of two-month highs and the strengthening of the "hawkish" rhetoric of central banks. Regulators from different countries are ready to follow the Fed's example and embark on a path of monetary tightening that promotes the growth of bond yields around the world and also led investors to withdraw money from ETF, focused on precious metals. Thus, the reserves of the largest specialized exchange-traded fund SPDR Gold Shares dropped to 846.29 tonnes, the lowest level in almost three months.

In terms of seasonality, July is not the best period for the "bulls" on the XAU/USD. Over the past 10 years, the average price grew by less than 1%, which is significantly worse than the statistics of January (+3.9%).

Seasonal dynamics of gold

Source: Bloomberg.

The main driver of falling prices is currently the unfavorable external environment. In spite of a slowdown in inflation, central banks are going to tighten monetary policy as they look at the positive dynamics of the GDP. US stock indexes feel comfortable near record highs, the yield on US treasury bonds is rising, and the dollar is recovering lost ground. Thus, the global appetite for risk remains high while inflation is low. Both factors are "bearish" for a safe haven like gold.

UBS notes that precious metals are very sensitive to the dynamics of the real yield of US bonds. According to him, the latter will be traded in a medium term range, so the bank recommends buying XAU/USD at near $1,200 per ounce and sell it near $1,300. From a fundamental point of view, the drop in prices to the first level will boost the demand for gold in order to hedge the risks associated with potential correction of the S&P 500.

The dynamics of the real yield of US Treasury bonds and gold prices

Source: Bloomberg.

In the short term, strong US labor market data in June will persuade the Federal Reserve to proceed with its plans and increase the nominal yield on bonds. On the other hand, weak non-farm payrolls and average wages will reduce the likelihood of three interest rate hikes in 2017 and will pull down the yield. This will allow the "bulls" on the XAU/USD to go into a counterattack.

Despite recent setbacks, the market still has a lot of supporters for the recovery of medium-term trend growth in precious metals.

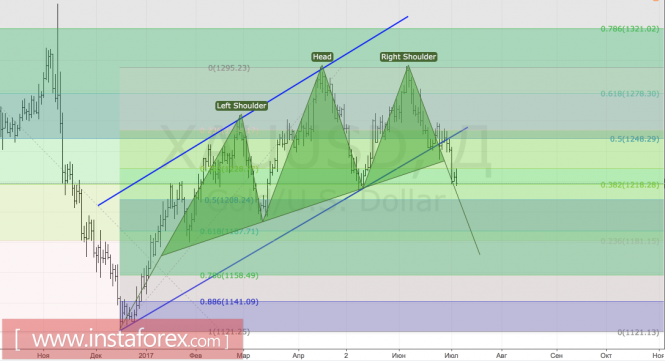

Technically, prices going beyond the upward trading channel and the breakthrough of the neckline of the "Head and Shoulders" pattern indicates a breakdown in the medium-term "bullish" trend. The attack of the "bears" was stopped at the support level of $1,218 per ounce, however, success in its retest will raise the risks of sustaining the peak towards the direction of $1,208 and $1,190.

Gold Daily Chart