In the past few weeks, the oil market has clearly become dull, looking at the tug-of-war between OPEC and US oil producers. It needed a new driver to get out of a tired state, and news from the International Energy Agency and from China could stir "bulls" for Brent and WTI. China announced a 5.1% year on year decline in domestic production and a 14% rise in imports, while the IEA raised forecasts for global demand by 100,000 in 2017-2018 (1.4 million b/d). At the same time, the decline in US stocks, by 7.56 million barrels in the week ended July 7, has reminded investors of the summer which is the height of the driving season and strong domestic demand.

A moderate optimism prevailed in the market. Increasingly, there is talk claiming that the trading range of $40-50 per barrel is sustainable and that when approaching its lower border, "bulls" are actively buying. A number of companies believe that the worst is over, however, a V-shaped recovery still isn't expected. Prices are quite capable of staying in the bottom for a long time. Moreover, the shale mining of oil in the US in August will likely grow for the eighth straight month, reaching 5.585 million b/d, and Ecuador, which is involved in the OPEC deal, begins to put its personal interests above that of others. It is not enough for Libya and Nigeria, whose activities has forced the cartel to reduce the rate of fulfillment of obligation to lower production from 90-95% to 78% in June.

According to sources cited by Bloomberg who are familiar with the actual data, the production of oil in the 11-members bound by OPEC's output cut agreement in June increased from 29.69 to 29.89 million b/d. A clear "bearish" signal for the Brent and WTI, which is pressured by talks in St. Petersburg, during which the Monitoring Board will draw conclusions about the activities of individual members of the cartel.

"Bulls" are counting on a further decline in US stocks. According to the forecasts of Bloomberg experts, in the week ended June 14, the index will be at 3.6 million bpd, which will add to optimism on domestic demand. Speculators rely on this factor, as shown by the increase in net longs for WTI of 19% to 178,654 futures and options contracts, which is the fastest trend in the last 7 weeks. Net long positions in Brent at the end of the five-day period ended July 11 also increased, reaching 232,135.

The dynamics of speculative positions and oil prices

Source: Bloomberg.

Support for oil comes from the weakening US dollar. The loss of investor confidence in Donald Trump, weak data on inflation and retail sales and falling likelihood of a hike in the federal funds rate in 2017 made the US currency a clear outsider. If not for this then oil would have it hard.

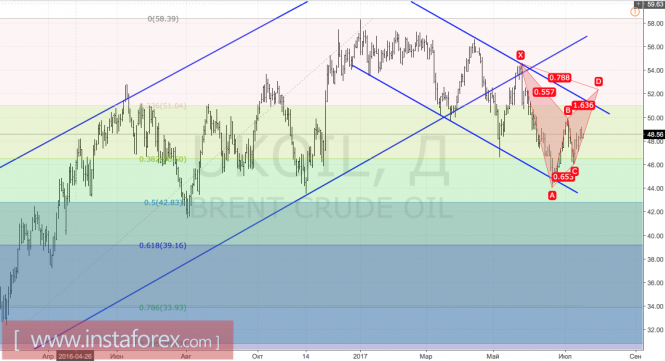

Technically, a breakthrough resistance at $49.3 per barrel will increase the risk of activating a reversed Gartley pattern with a target of 78.6%. It corresponds to the level of $52.4. To begin with, "bulls" need to succeed in levels of $50 and $51 per barrel.

Brent, daily chart