After OPEC stopped paying attention to other people's drawn straws and admitted their respective faults, oil prices resumed growth. According to the Petro-Logistic research, the cartel increased its production of black gold to 33 million b/ d, which is 145, 000 b /d more than in June. Obviously, the root of all problems should be sought not in the U.S. States with their shale, but within the group of participants in the Vienna agreement. In this regard, the pressure on individual countries by Russia and Saudi Arabia can produce results. However, there are risks of getting discontent from the agreement, which will be an unpleasant surprise for the "bulls" for Brent and WTI.

Representatives of Riyadh during the St. Petersburg summit noted that reducing production is not a universal fix. OPEC continues to supply oil to the world market in almost the same volumes, as some countries have retained or are increasing the scale of exports. Thus, the production of black gold by the cartel in October-June decreased by 920 thousand b/d, while shipments abroad - fell only by 120 thousand b/d. As a result, despite the global reserves declining by 90 million barrels, their total number is still 250 million barrels higher than the five-year average of the indicator for the current time of the year. In order to set an example, Saudi Arabia is ready to reduce its exports from 6.9 million b/d in May to 6.6 million b/d in August. The recent figure is 1 million b/d less than last year's monthly maximum.

Moscow believes that the source of destabilization in the market are Nigeria and Libya, which should take an active part in the deal to reduce production.

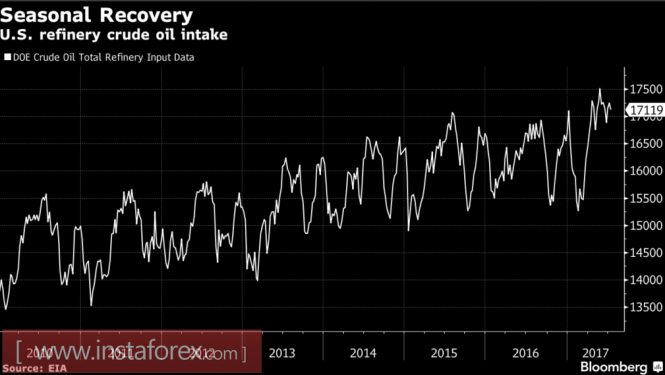

If the cartel can solve its internal problems, normalize production and export of black gold, then against the background of growing global demand, the probability of restoring the "bullish" trend for Brent and WTI will increase. In particular, according to studies by the International Energy Agency, global demand for oil from processing companies in August will reach a peak of 81.4 million barrels. At the beginning of the car season in the US.. in May, it was around 80.1 million barrels. U.S. refineries will process a record 17.5 million barrels, which is higher than during same periods in 2015-2016.

The dynamics of demand for oil from US refineries

Source: Bloomberg.

Positive for the "bulls" for black gold news came from China. In January-June, the Celestial Empire imported 212 million tons of oil, or 8.55 million b/d, which is 14% higher than in the previous year. According to the analysis of Sinopec, by the end of 2017, the import will exceed the level of 400 million tons. Simultaneously, Barclays frightens the "bears" with a view with a forecast of an increase in prices by $ 5-7 per barrel as a result of interruptions with supplies from Venezuela.

Technically, to restore the upward trend for the Brent "bulls", a successful resistance break is required at $ 50.1 per barrel.

Brent, daily chart