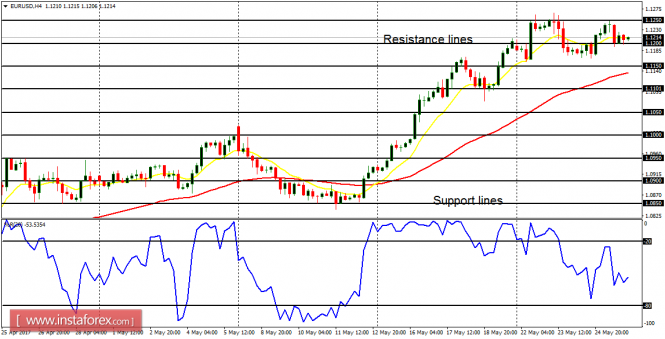

EUR/USD: This pair has moved between the support line at 1.1150 and the resistance line at 1.1250 (which has been tested several times this week). The resistance line is supposed to be breached to the upside as the market trends upwards. When that happens, the next target would be the resistance line at 1.1300.

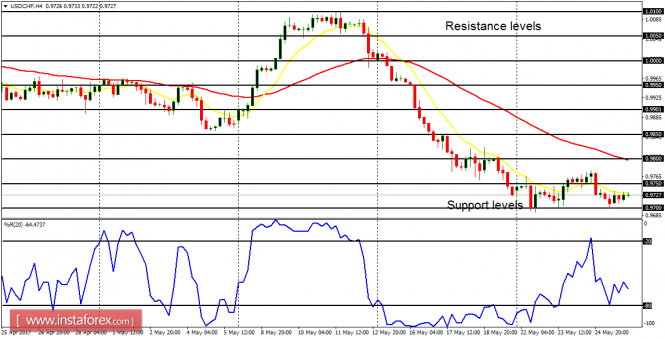

USD/CHF: A bearish signal remains on the USD/CHF pair, although price has moved largely sideways this week (in the context of a downtrend). A rise in momentum is anticipated, which would happen today or next week, and which would most probably favor bears.

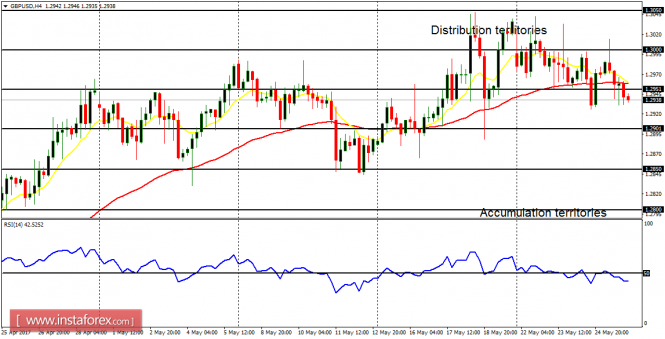

GBP/USD: This market has already generated a "sell" signal. As it was forecasted at the beginning of this week, bearish movements on certain other GBP pairs have forced a bearish propensity on GBP/USD. The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50. We may see drop of at least, 200 pips between now and the end of next week.

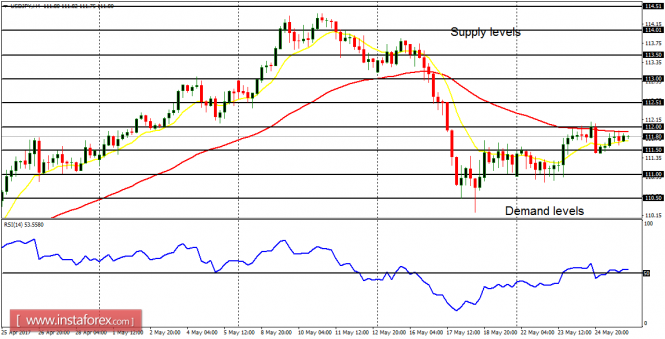

USD/JPY: The USD/JPY pair has been consolidating to the upside, and this has resulted in a threat to the short-term bearish bias on the market. A movement above the supply levels at 112.50 and 113.00 would result in a Bullish Confirmation Pattern on the 4-hour chart. Then, the indicators on the chart would have all supported a rally. Only the RSI period 14 is giving a bullish signal right now.

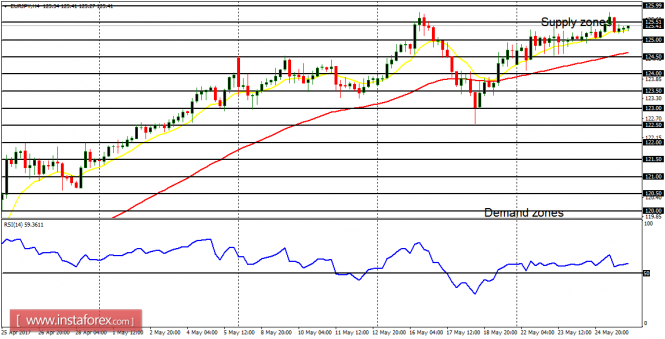

EUR/JPY: This cross pair has also consolidated so far this week, though there is still a bullish outlook on the market. A breakout to the upside is expected today or early next week, which may enable the supply zones at 125.50, 126.00, and 126.50 to be tested. Since the market is currently quiet, there could be a measure of high volatility next week.