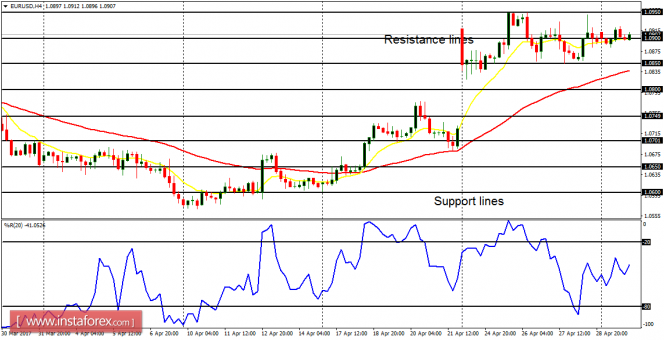

EUR/USD: This currency trading instrument is currently consolidating in the short-term, while the bias is bullish (though that is supposed to be a temporary thing). The outlook on the market (as well as other EUR pairs), is bearish for this week. This means the gap that opened last week might eventually be filled.

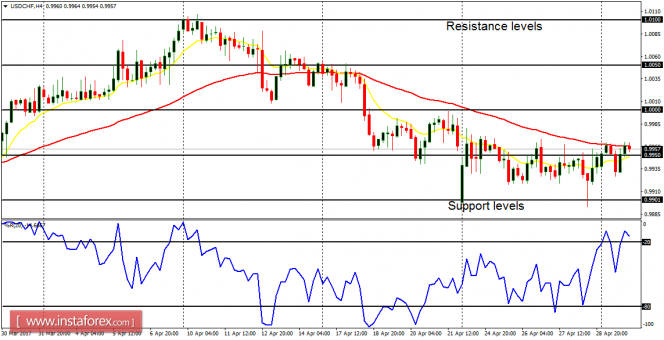

USD/CHF: This pair did not do anything significant yesterday. This week and next, the market is supposed to move below the support levels at 0.9900 and 0.9800, reinforcing the current bearishness in the market. On the other hand, the market could go above the resistance levels at 1.0000 and 1.0100, creating a Bullish Confirmation Pattern in the 4-hour chart.

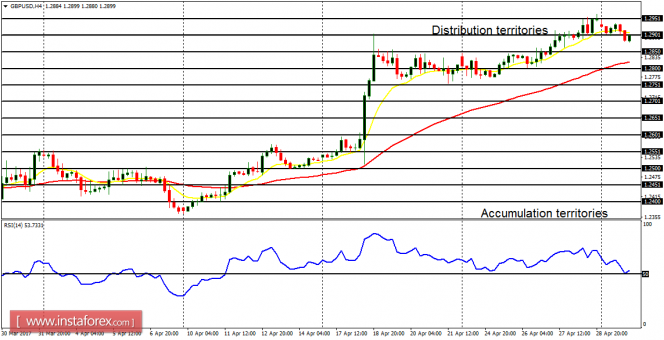

GBP/USD: The Cable made a weak effort to go south on Monday; though the bullish bias remains intact. This week, the price is supposed to go further upwards, reaching the distribution territories at 1.2950, 1.3000 and 1.3050. The outlook on most other GBP pairs is also bullish.

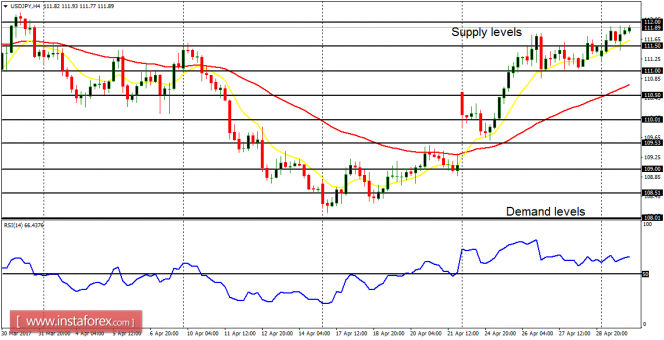

USD/JPY: Just like the EUR/JPY, the USD/JPY is also making some bullish effort. The supply levels at 112.50 and 113.00 may be tested, as price goes further upwards, following the gap-up that occurred last week, which has resulted in a bullish bias. At last, there would be a pullback in the market, which could threaten the current bullish bias.

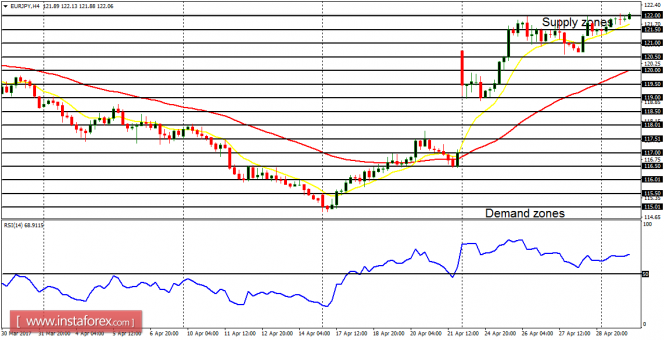

EUR/JPY: The EUR/JPY has been attempting to trend further upwards, following the gap-up that happened last week. There is a clear Bullish Confirmation Pattern in the market, and further rally is possible this week. However, the price would eventually come down, because the outlook on JPY pairs is bearish for this month.