Trading plan for 06/04/2017:

EUR/USD rebounded towards the upper limit of the narrow band (1.0630-1.0690) which is valid this week. USD/JPY defends the area of 110.20-110.30 defining a strong support zone. The Australian currency can't benefit from the greenback's weakness as AUD/USD is down nearly 0.5% and it declines further to a new local low below 0.7550. Yesterday's sharp rebound on the crude oil market is also not conducive to a rise of CAD and NOK. WTI is currently priced belowweakest $50.90, which means that its rate since yesterday's peak has already fallen 2%. The weak sentiment on Wall Street is also reflected in the behavior of Asian indexes. Among the weakest is the Nikkei 255 which is down 1.5%. The futures contract for this stock exchange breaks through the key lows of January, setting the lower band of the range around 1,100 points.

On Thursday 6th of April, the event calendar is not very busy but global investors will keep an eye on the ECB Monetary Policy Meeting Minutes release and the Unemployment Claims data from the US. Moreover, Mario Draghi and Jens Weidmann's speeches in Frankfurt may catch some interest as well.

EUR/USD analysis for 06/04/2017:

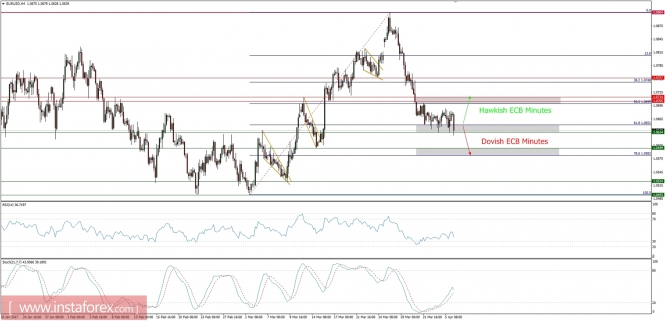

Mario Draghi's speech and the ECB Monetary Policy Meeting Minutes will be the key macroeconomic events that will cause some volatility in the euro pairs. The most important message from the ECB Minutes for global investors is the overall tone of the statements: hawkish or dovish. Another important message is any mention of the current policy change regarding the QE and interest rate increase/decrease. Dovish tones from the ECB Minutes will send the euro pairs lower, whereas hawkish comments will trigger a rally.

Let's now take a look at the EUR/USD technical picture on the H4 time frame. The market is currently testing the 61% Fibo support again, but no clear and sustained break out has been made yet. The trading range is still the same as no trigger has occurred yet: technical support is seen at the level of 1.0634 while technical resistance lies at the level of 1.0699.

USD/JPY analysis for 06/04/2017:

The Unemployment Claims data from the US are scheduled for release at 12:30 pm GMT. Market participants expect a slight decrease from 258k to 251k for the reported week. Yesterday's surprisingly strong jobs report for the private sector in March throws cold water on the view that the US economy is stumbling. Today's job report may add more evidence that the labor market is still expanding at a healthy pace. Therefore, the Federal Reserve will have another reason to consider raising interest rates again, perhaps as early as next month's FOMC meeting.

Let's now take a look at the USD/JPY technical picture on the H4 time frame. The market is trading around the local support at the level of 110.10, possibly waiting for the jobs data to trigger the move. If the jobs data exceeds expectations, then the price will rally towards the level of 110.56 again. If the job data is worse than expected, then the price will test and possibly break below the technicall support at the level of 110.10.

from www.instaforex.com