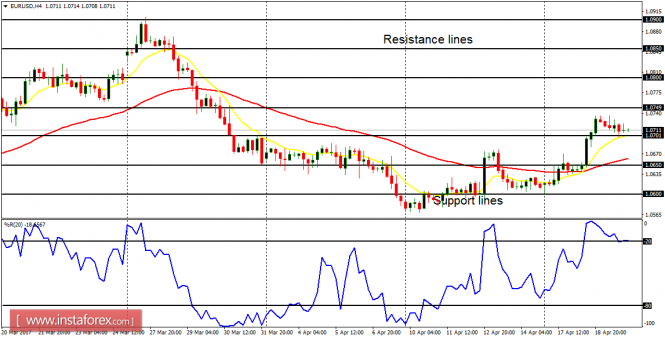

EUR/USD: There is already a "buy" signal on this market. Price went upwards this week, and it is now above the support line at 1.0700. The next targets for bulls are located at the resistance lines at 1.0750, 1.0800, and 1.0850.

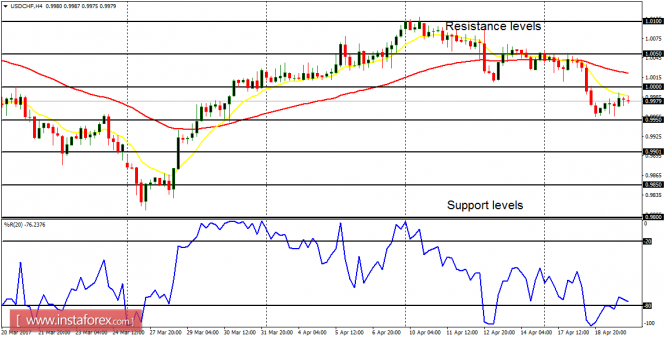

USD/CHF: The USD/CHF pair has dropped southwards this week. The EMA 11 is below the EMA 56, and the Williams' % Range period 20 is not far from the oversold region. Price is currently consolidating, but it would drop further. It is below the resistance level at 1.0000 and going towards the support level at 0.9950.

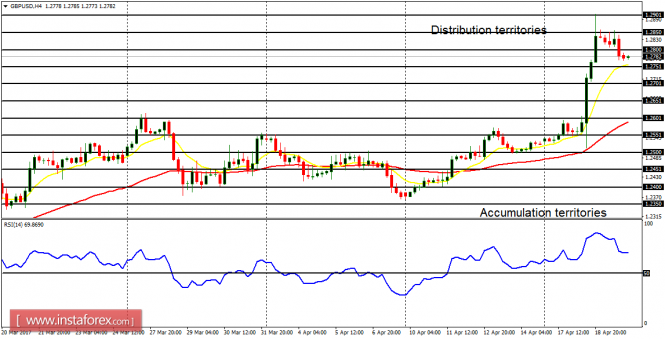

GBP/USD: Following the massive rally that was seen this week, the Cable has been caught in a shallow retracement. The retracement is bearish, and it would turn out to be an opportunity to buy long at better prices in a context of a huge uptrend. Some fundamental figures are expected today and they may have impact on the market.

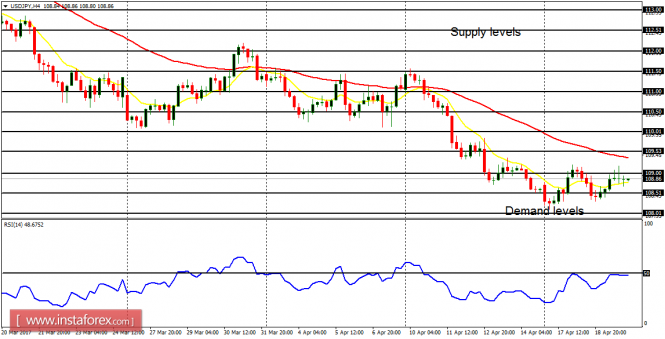

USD/JPY: In the short term, the USD/JPY pair is quite choppy. There is a huge Bearish Confirmation Pattern on the 4-hour chart. Since the outlook on JPY pairs is bearish, USD/JPY also could be seen going further and further southwards, reaching the demand levels at 108.50, 108.00, and 107.50.

EUR/JPY: The EUR/JPY pair has continued the upwards correction it started at the beginning of this week. Once price moves above the supply level at 117.50, the bias would turn bullish. Failure to breach that supply level to the upside would result in further emphasis on the ongoing dominant bearish outlook.