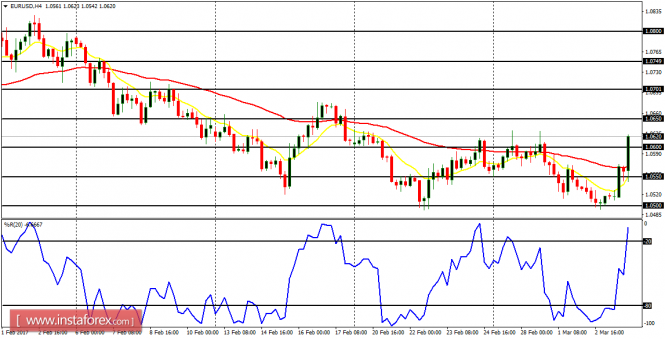

EUR/USD: This market moved slightly south last week, reaching support line at 1.0500, and then bouncing upwards on Friday. The upwards bounce is supposed to be a temporary rally in the context of a downtrend, unless price goes above the resistance line at 1.0700 (which would inevitably lead to a new bullish outlook).

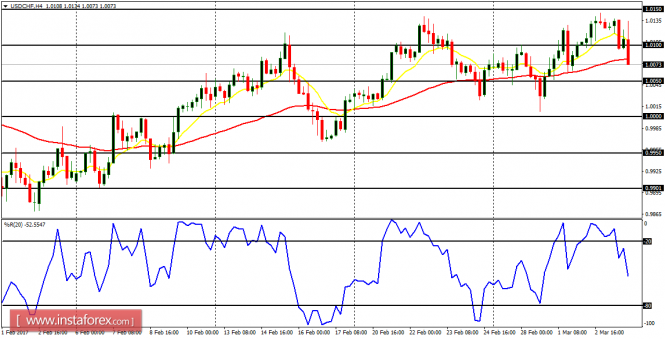

USD/CHF: There is a faint bullish signal on this pair, and price would continue going upwards only as long as the EUR/USD continues moving south (irrespective of occasional rally attempts on the latter). A movement below the support level at 1.0000 would lead to a bearish signal, while a movement above the resistance level at 1.0150 would reinforce the extant bullishness.

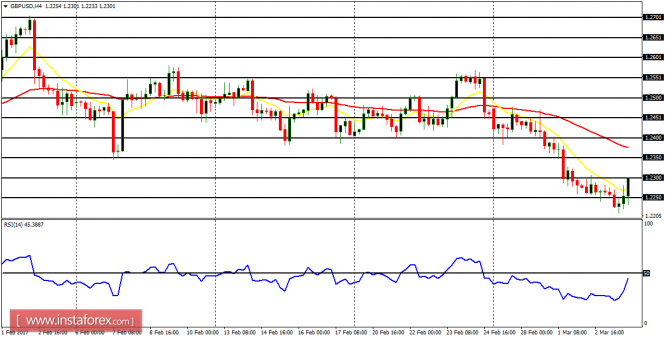

GBP/USD: The GBP/USD moved south by around 230 pips last week; thus ending the recent neutral bias on the market. Price bounced upwards on Friday, but that would most probably turn out to be an opportunity to go long in the market, while things are on sale. There is a Bearish Confirmation Pattern in the market, and the outlook on other GBP pairs is also bearish for the week.

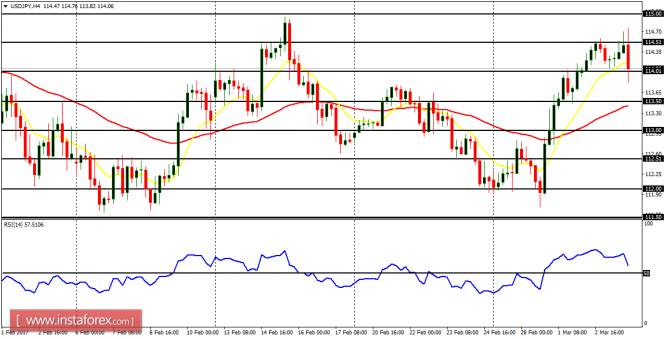

USD/JPY: This currency trading instrument trended upwards by 250 pips last week – from the demand level at 112.00 to the supply level at 114.50. There is a clean bullish signal in the market, which has come as a result of a bullish expectation on this instrument (as well as on other JPY pairs). The supply levels at 115.00 and 115.50 could be tested this week, and those are the initial targets for this week.

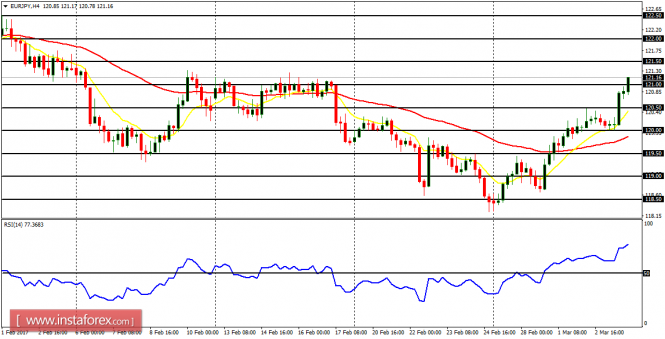

EUR/JPY: The EUR/JPY moved up by 270 pips last week, closing above the demand zone at 121.00. There is a strong Bullish Confirmation Pattern in the 4-hour chart, and further upwards movement is expected this month, which would take price toward the supply zones at 121.50, 122.00 and 122.50.