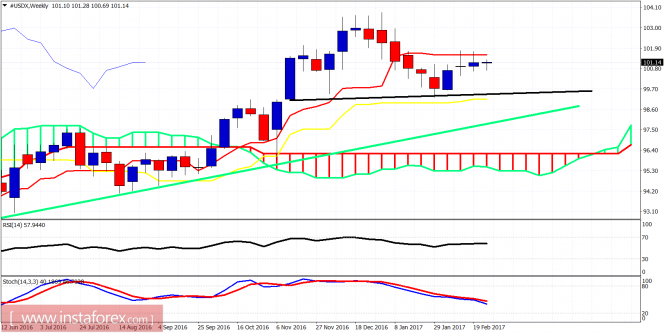

The Dollar index is trading sideways between important resistance of 101.80 and support at 100.40. This indecision is very clearly portrayed in the weekly charts. We are at a very critical junction. Soon we will see if the bullish scenario for new highs gains more chances of success or the bearish scenario of the Head and Shoulders pattern.

Red line - support

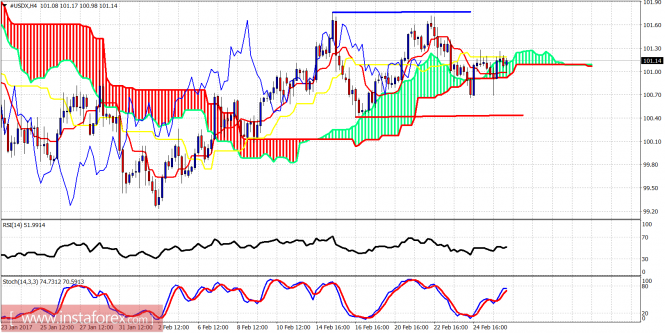

The Dollar index is trading around the 4-hour Ichimoku cloud. This confirms the indecisiveness. Traders need to be patient. Short-term support is at 100.70 and a break below it will increase the chances of breaking 100.40. Resistance is at 101.80.

Green line - long-term support trendline

The weekly chart remains right below the tenkan-sen (red line indicator). The inability to break above it is not a good sign and increases the chances that we are forming the right hand shoulder of a bearish Head and Shoulders pattern with 99.25 as the neckline and 95 as the target if the neckline breaks. A break however above 102 on a weekly basis will be a bullish sign confirming the low at 99.25 and the target of 105-110.

The material has been provided by InstaForex Company - www.instaforex.com