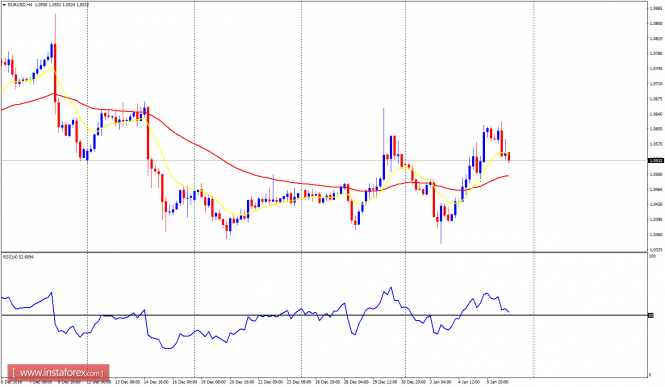

EUR/USD: The EUR/USD has generated a "buy" signal since the middle of last week. In spite of the bearish retracement that was seen on Friday, the bullish signal is still in place. This week, bulls would try to target the resistance lines at 1.0600, 1.0650 and 1.0700. Any bearish retracements seen here could turn out to be another "buy" signal.

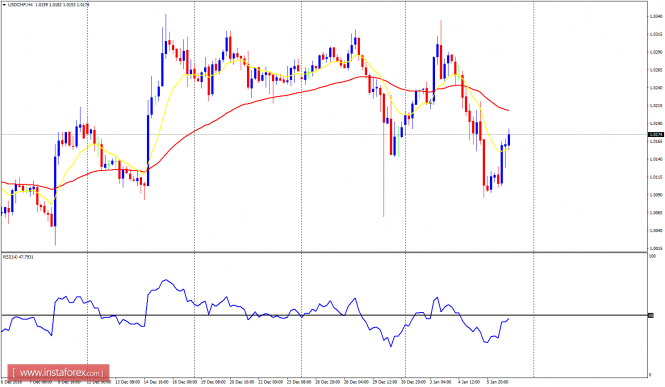

USD/CHF: The USD/CHF has generated a "sell" signal since the middle of last week. However, the sell signal is valid only in the short-term. There can be a long-term sell signal only when the psychological level at 1.0000 is breached to the downside. There can be bearish movements in the short-term and the current rally in the market is an indication of another short-term selling opportunity.

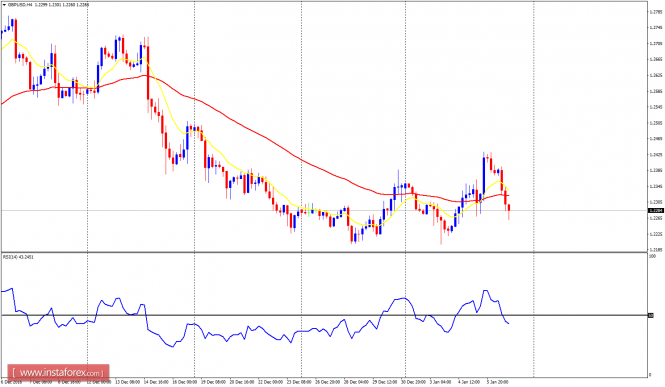

GBP/USD: The GB/USD went downwards on Friday – something that could jeopardize the recent short-term bullish signal in the market. A breach of the accumulation territory at 1.2200 would result in a bearish signal, and a movement of about 200 pips to the upside would support the recent bullish signal.

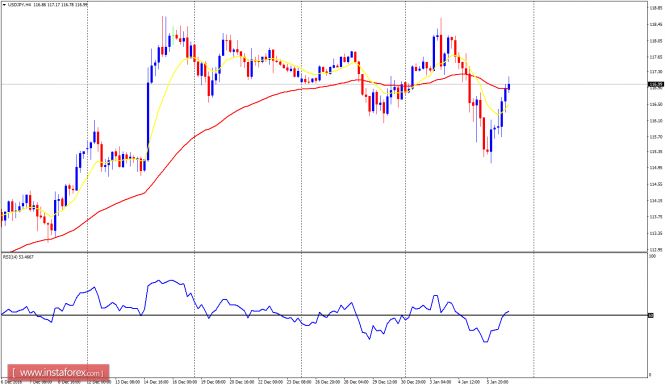

USD/JPY: This pair came down significantly on Thursday, only to move upwards on Friday. The outlook remains bearish unless price goes upwards by another 150 pips (a situation that would lead to a bullish signal). There are demand levels at 116.00, 115.50 and 115.00, which could be reached this week.

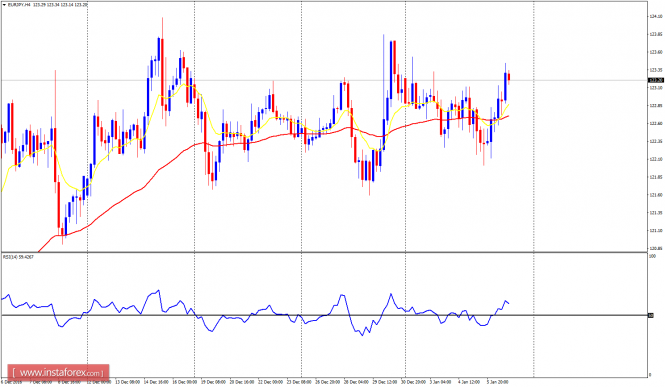

EUR/JPY: This cross pair has been quite choppy and turbulent. Price has been going sideways for a long time, but lately, bulls are making effort to push price upwards. In the near-term, the outlook is bullish and price can move upwards by at least, 150 pips this week, reaching the supply zone at 123.50, 124.00 and 124.50.